HurryTrade

No content yet

HurryTrade

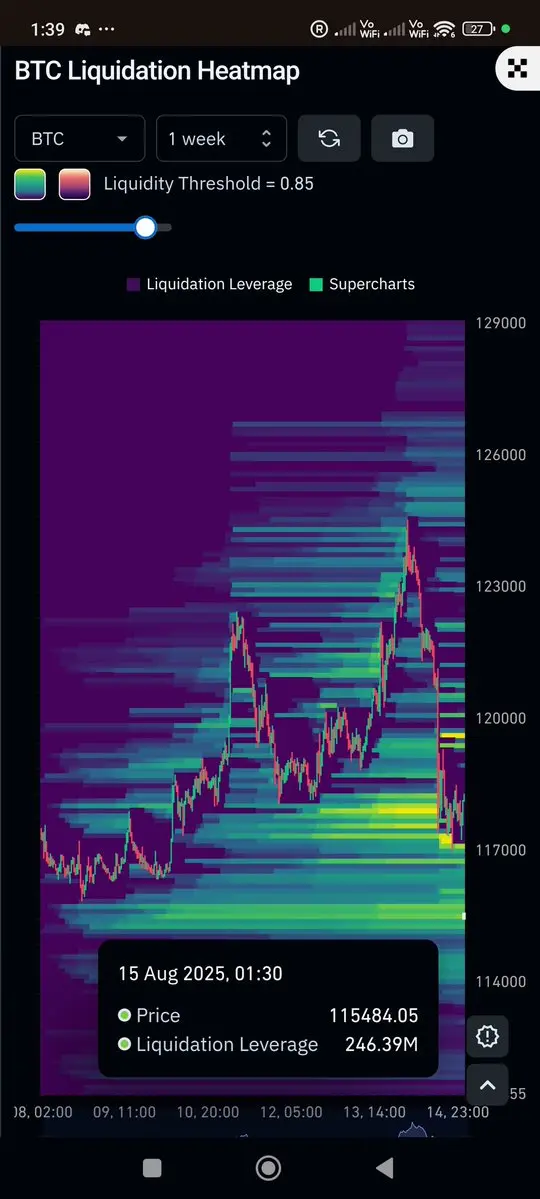

#BTC# Update

BTC broke out into a new all-time high and made a 6% correction from the top. The big drop came after the terrible PPI numbers and people suddenly got terrified. CT is burning with people calling for lower.

However, S&P didn't even blink and the market is still pricing in a 92.5% possibility of a rate cut despite the PPI numbers.

At 117,560 there was the EQ of the range before the breakout. It worked as a support level many times, so there was liquidity below it. I expected that level to be swept before the move up, but the vice versa happened.

Now, the new EQ of our August range

BTC broke out into a new all-time high and made a 6% correction from the top. The big drop came after the terrible PPI numbers and people suddenly got terrified. CT is burning with people calling for lower.

However, S&P didn't even blink and the market is still pricing in a 92.5% possibility of a rate cut despite the PPI numbers.

At 117,560 there was the EQ of the range before the breakout. It worked as a support level many times, so there was liquidity below it. I expected that level to be swept before the move up, but the vice versa happened.

Now, the new EQ of our August range

- Reward

- like

- 7

- Repost

- Share

Johnnie9 :

:

Ape In 🚀View More

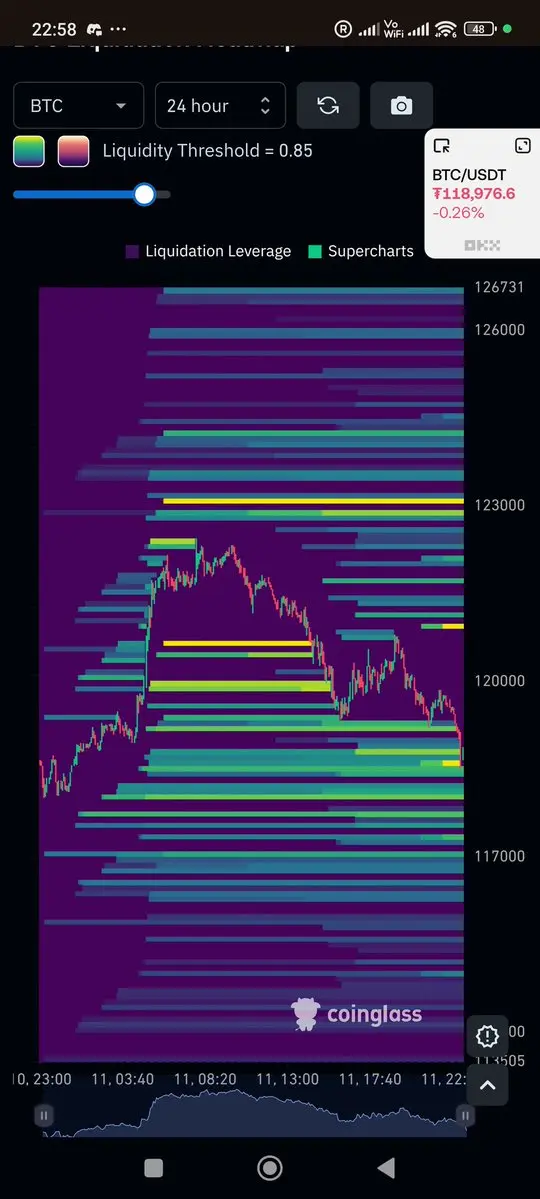

#BTC# and #ETH# Quick Update

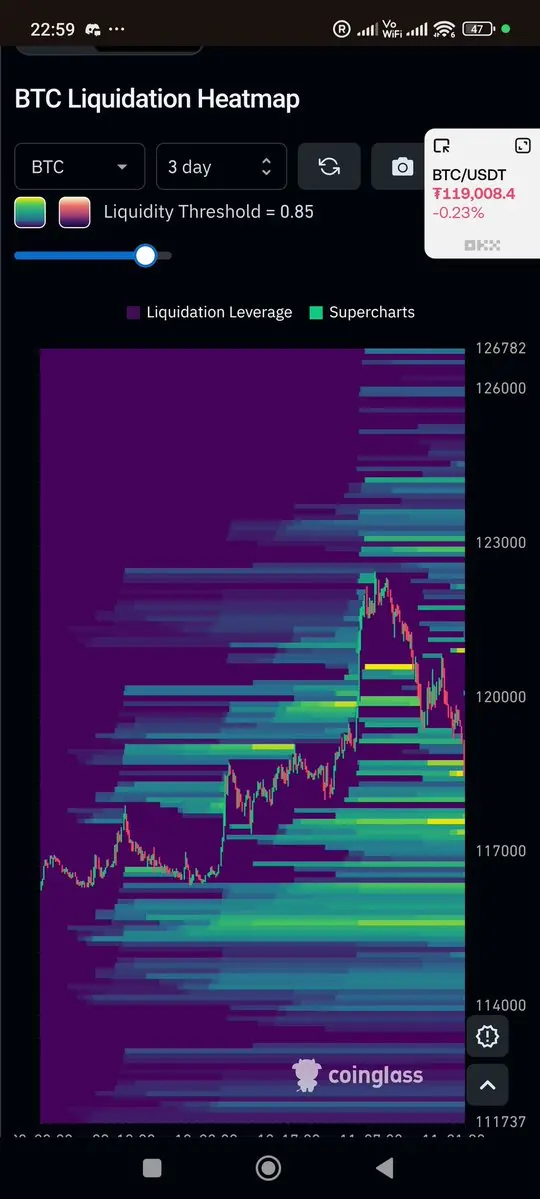

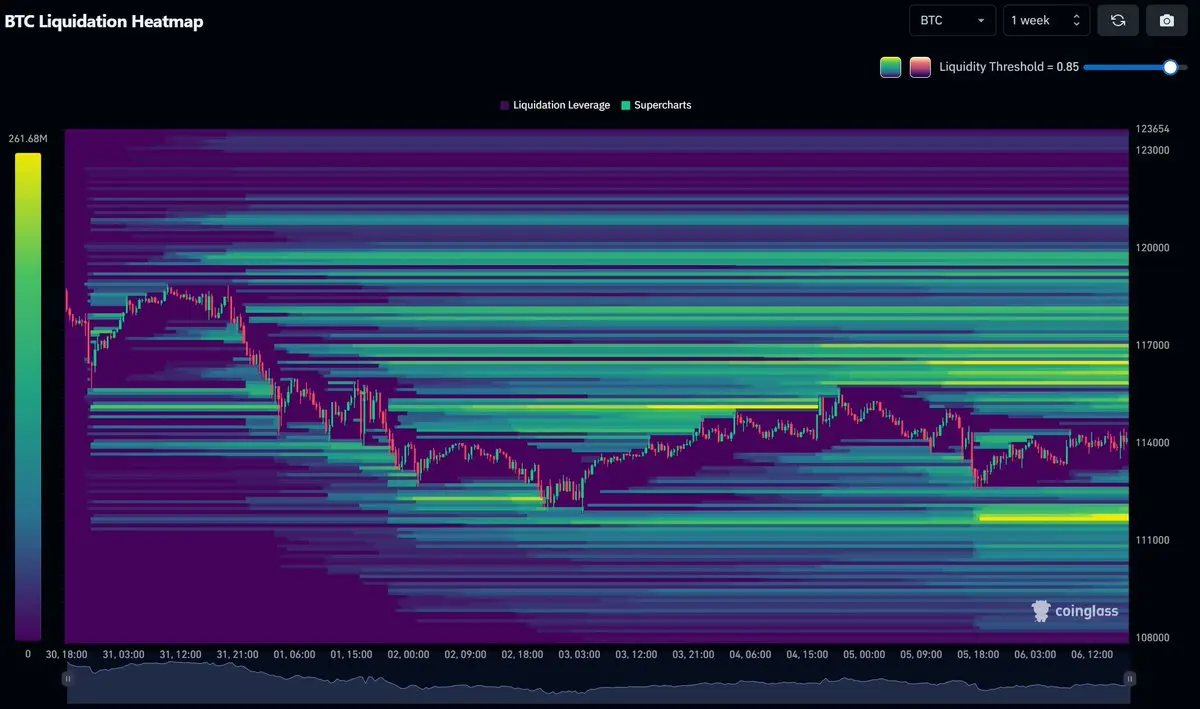

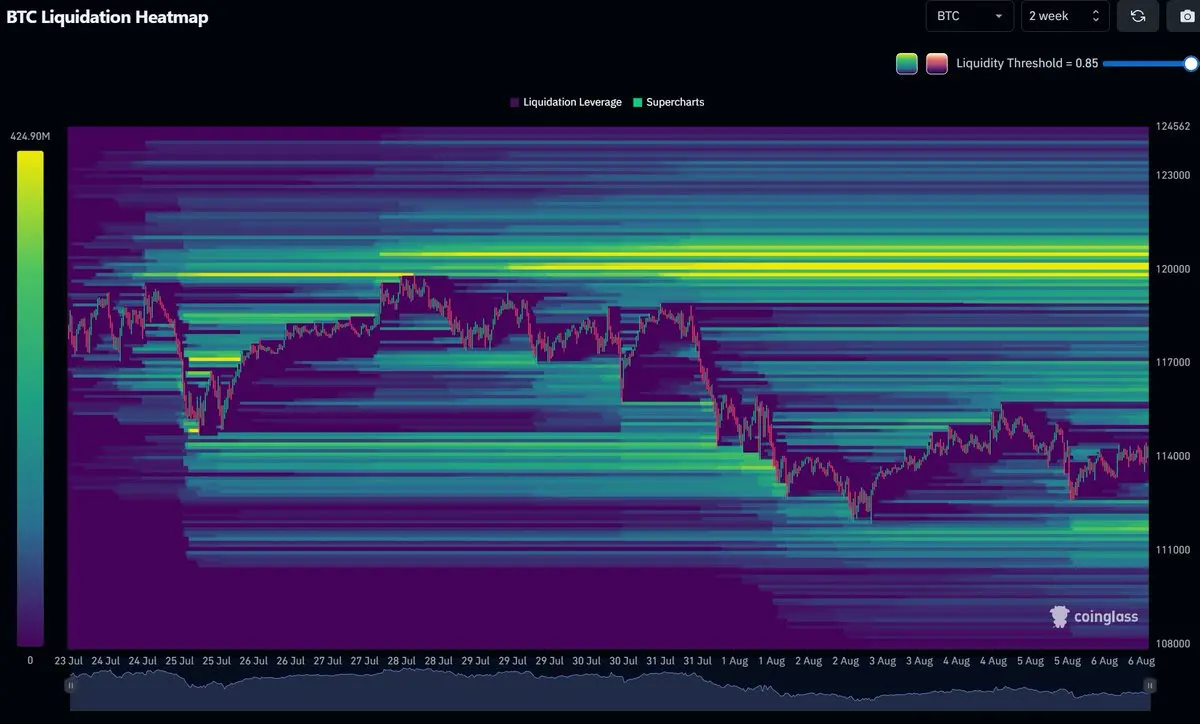

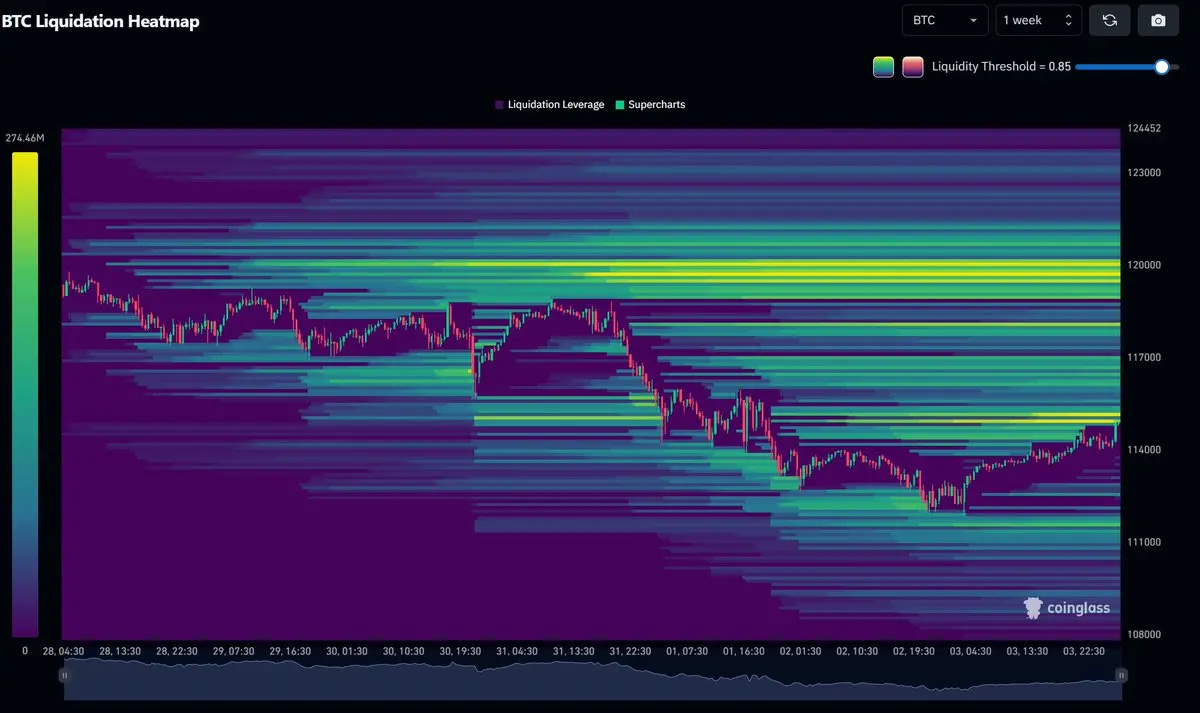

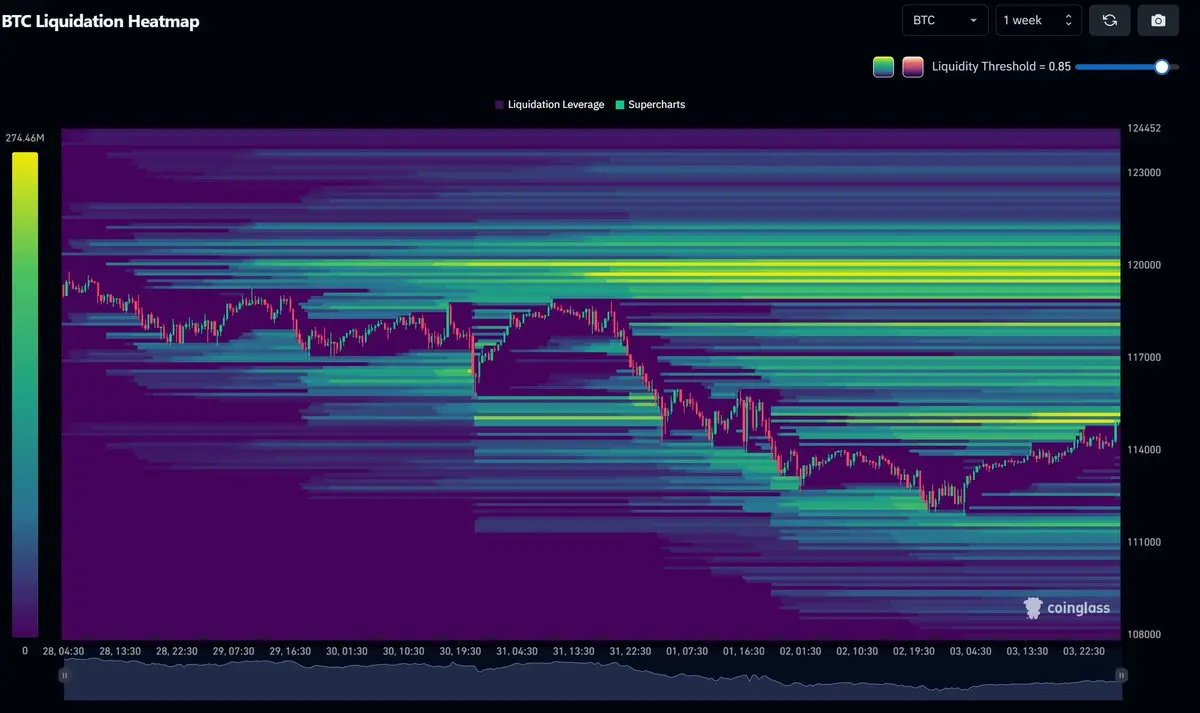

BTC and ETH 24h liquidity zones are swept.

However

BTC 3-day liquidity is at 117.6k and Weekly liquidity is at 115.4k. Both levels have confluence with technical levels (see previous update).

ETH weekly liquidity is at 4135 which is lower than the weekend low. It also falls between the extension levels of yesterday's range (4123-4140). It makes sense as ETH already swept the higher end of the extension (4352-4370).

BTC and ETH 24h liquidity zones are swept.

However

BTC 3-day liquidity is at 117.6k and Weekly liquidity is at 115.4k. Both levels have confluence with technical levels (see previous update).

ETH weekly liquidity is at 4135 which is lower than the weekend low. It also falls between the extension levels of yesterday's range (4123-4140). It makes sense as ETH already swept the higher end of the extension (4352-4370).

- Reward

- like

- Comment

- Repost

- Share

#Altcoins# Update

In my pinned post, I told you about an everything-up rally taking place in August. #ETH# is leading the way in this rally and Bitcoin Dominance finally broke below the 0.618 Fib level at 60.34% and also the ascending trendline that comes all the way from September 2022.

Now that BTC dominance is below 60%, altcoins will follow ETH more closely. We only need a weekly close tomorrow, and another red weekly candle the next week. I'm expecting a run at least to the EQ of the range at 56% during August. At the end of August, there might be a re-test of 60%, followed by a real alt

In my pinned post, I told you about an everything-up rally taking place in August. #ETH# is leading the way in this rally and Bitcoin Dominance finally broke below the 0.618 Fib level at 60.34% and also the ascending trendline that comes all the way from September 2022.

Now that BTC dominance is below 60%, altcoins will follow ETH more closely. We only need a weekly close tomorrow, and another red weekly candle the next week. I'm expecting a run at least to the EQ of the range at 56% during August. At the end of August, there might be a re-test of 60%, followed by a real alt

- Reward

- like

- Comment

- Repost

- Share

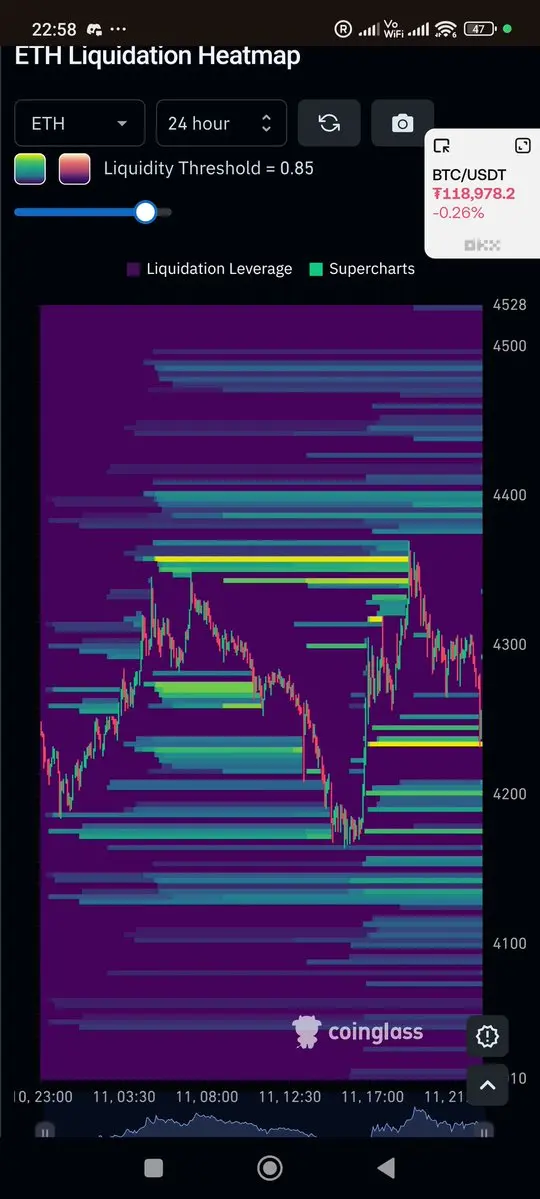

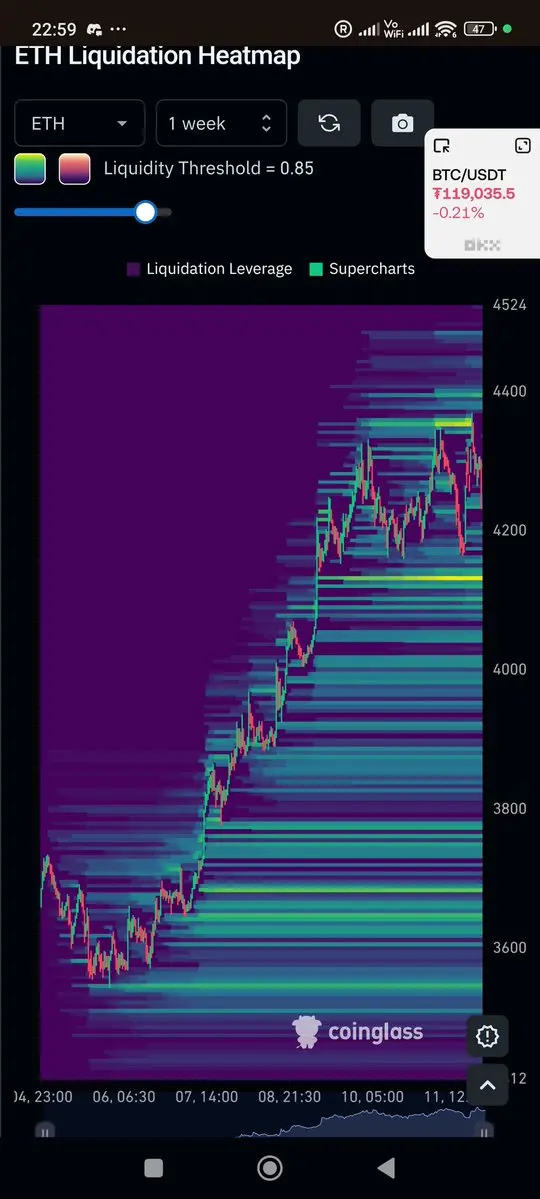

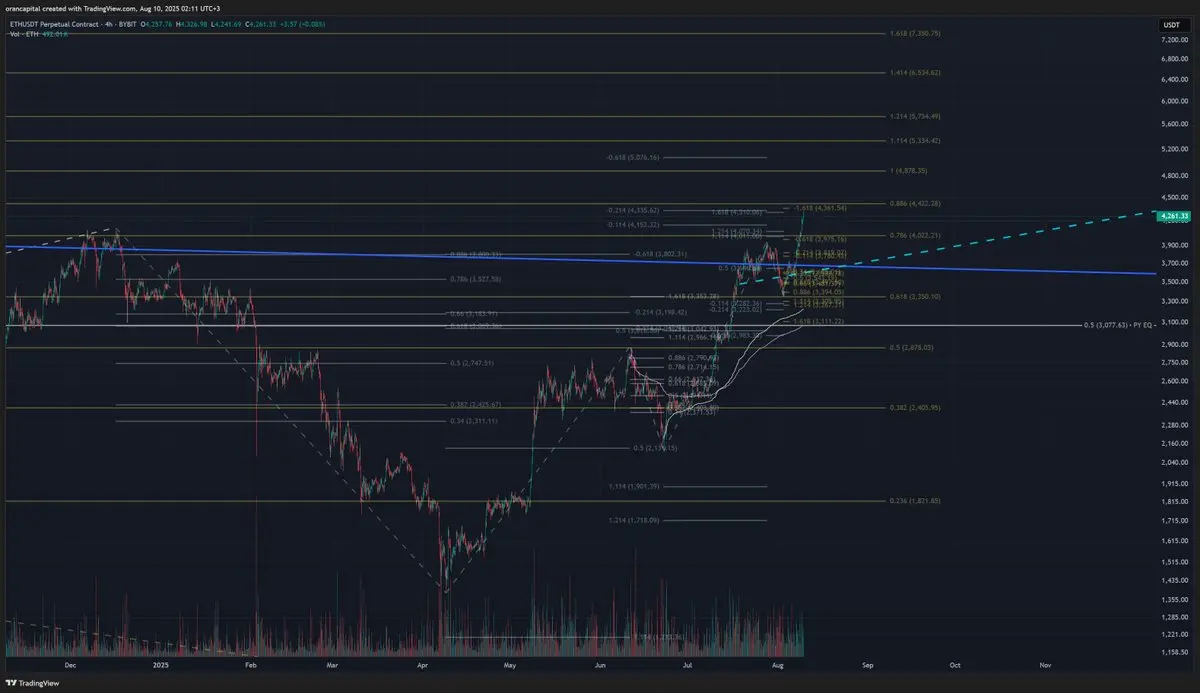

#ETH# Update

I told you many times that once ETH hit the 4000-4100 range, the resistance wouldn't work for another time so it would be smarter not to short that resistance - and here we are with ETH reaching up to $4327 without a pullback as of now.

Now let's look at ETH in terms of TA, liquidity and CVDs to come up with a plan.

Technical Analysis

-1.618 extension of the Monday Range is at 4361.

1.618 extension of the last drop is at 4310.

The first extension of the 21xx-39xx range is between 4152 and 4335.

0.886 level of the cycle (4878-878) is at 4422.

4377 is the May 2021 high.

This show

I told you many times that once ETH hit the 4000-4100 range, the resistance wouldn't work for another time so it would be smarter not to short that resistance - and here we are with ETH reaching up to $4327 without a pullback as of now.

Now let's look at ETH in terms of TA, liquidity and CVDs to come up with a plan.

Technical Analysis

-1.618 extension of the Monday Range is at 4361.

1.618 extension of the last drop is at 4310.

The first extension of the 21xx-39xx range is between 4152 and 4335.

0.886 level of the cycle (4878-878) is at 4422.

4377 is the May 2021 high.

This show

- Reward

- like

- Comment

- Repost

- Share

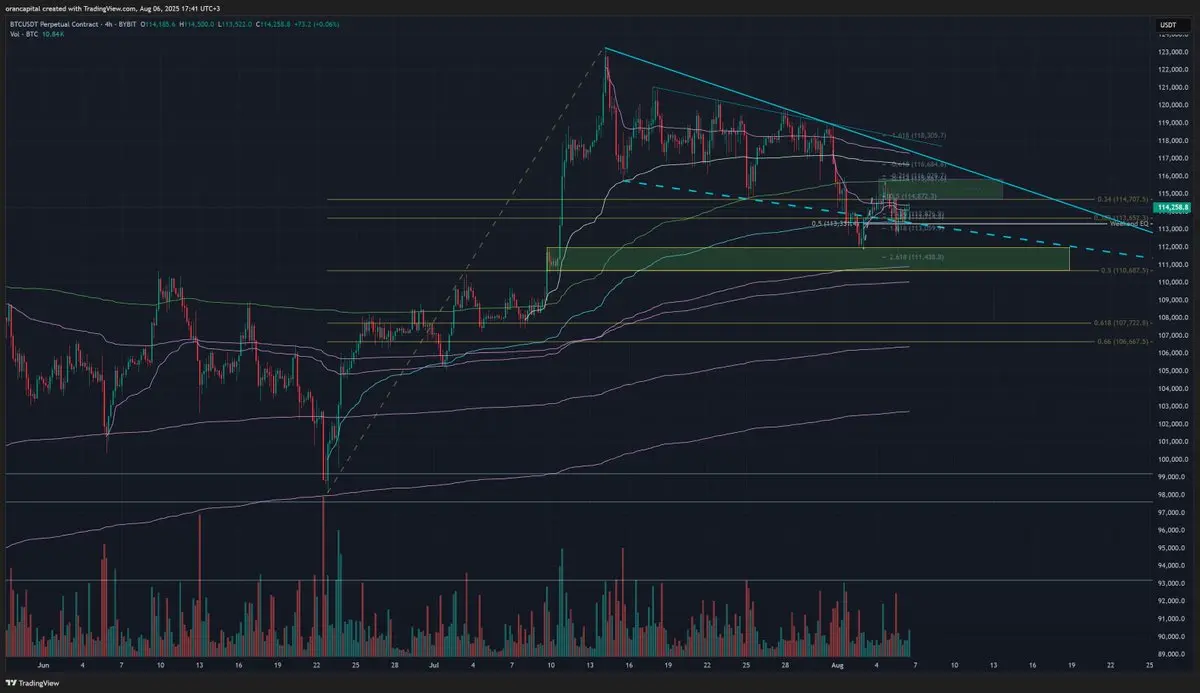

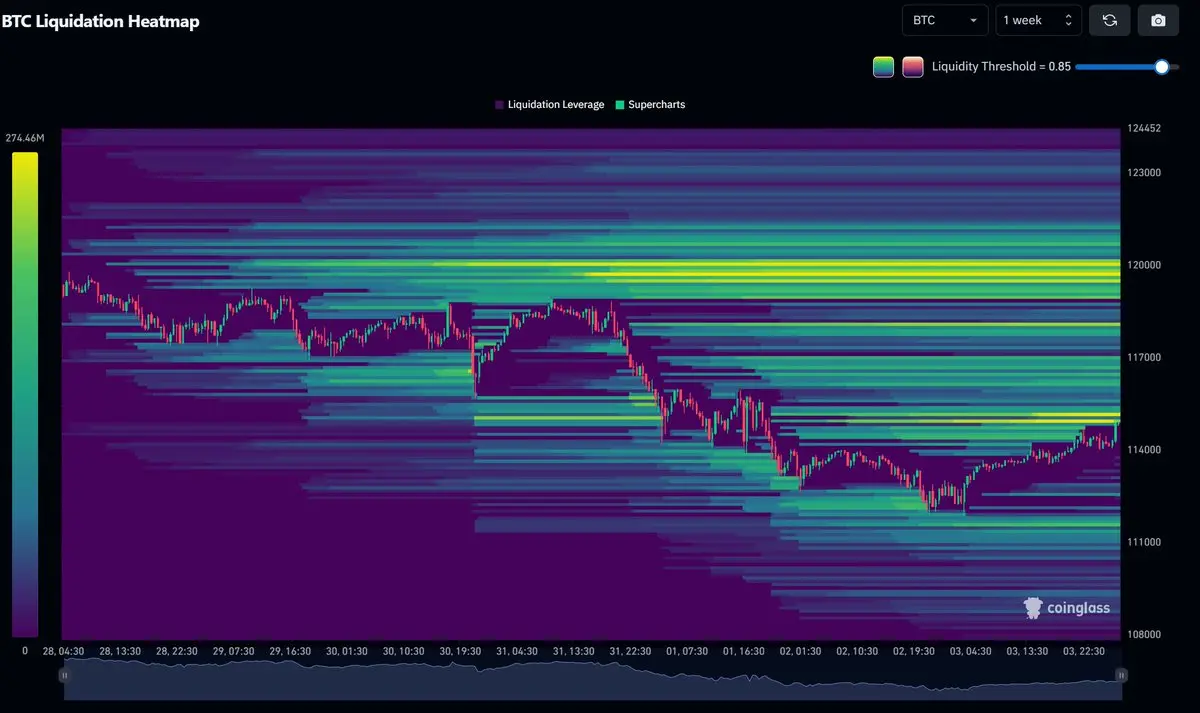

#BTC# Update

BTC has broken above one resistance after another without any major pullbacks. On each move, it tested the lower level before moving up a level, 113.3k, 114.3k, 115.7k and this time, the level is 116.7k. It made a similar move down to 116,764 but didn't violate the support like in the previous times.

This time we are at a more important level because BTC currently got rejected from the EQ of the 123k-112k range - that is 117,560. ~116,650 is our first support which is an important anchored VWAP. The next support levels are 115.7k and 114.7k.

BTC broke above the VWAP and the desce

BTC has broken above one resistance after another without any major pullbacks. On each move, it tested the lower level before moving up a level, 113.3k, 114.3k, 115.7k and this time, the level is 116.7k. It made a similar move down to 116,764 but didn't violate the support like in the previous times.

This time we are at a more important level because BTC currently got rejected from the EQ of the 123k-112k range - that is 117,560. ~116,650 is our first support which is an important anchored VWAP. The next support levels are 115.7k and 114.7k.

BTC broke above the VWAP and the desce

- Reward

- like

- Comment

- Repost

- Share

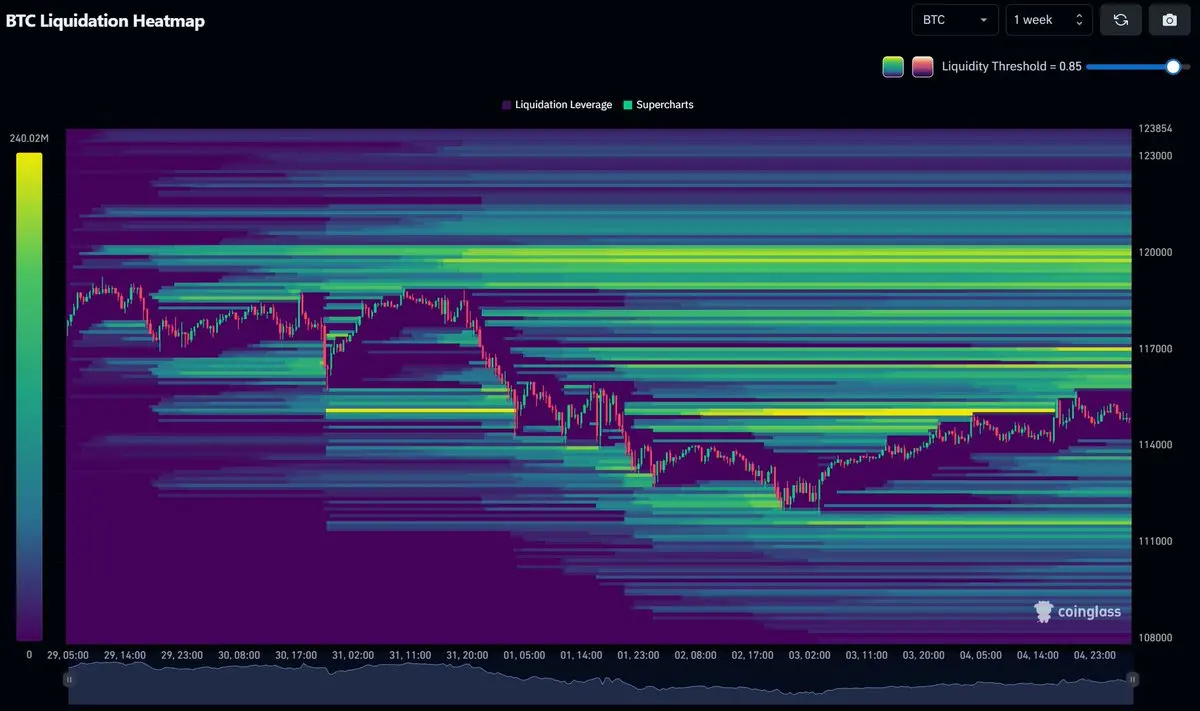

#BTC# Update

In my weekly plan, I suggested that a higher low at 112.5k was possible. Even though most of the times the weekend liquidity is swept during active trading hours during the weekdays, the market maker recently started front-running the traders by printing higher lows instead of sweeping the lower liquidity. This is mainly because the idea of "sweeping the weekend lows" has become common knowledge, and when everyone bets on the same idea, the probability of it decreases.

Price-wise, BTC is still very close to the lows, and also below the resistance levels. This is why a lower sweep

In my weekly plan, I suggested that a higher low at 112.5k was possible. Even though most of the times the weekend liquidity is swept during active trading hours during the weekdays, the market maker recently started front-running the traders by printing higher lows instead of sweeping the lower liquidity. This is mainly because the idea of "sweeping the weekend lows" has become common knowledge, and when everyone bets on the same idea, the probability of it decreases.

Price-wise, BTC is still very close to the lows, and also below the resistance levels. This is why a lower sweep

- Reward

- like

- 1

- Repost

- Share

Onlybosal :

:

gas come on new escrow I gas share connections, ideas, and opportunities that exist in its metamusk, and no one knows how the pump 🚀 works, right? Which one is the same as a small capital? #BTC# Update and Weekly Plan

Bitcoin initially got rejected in the -0.114 - -0.214 extension of the weekend range and then went higher to the Anchored VWAP +1stdev (anchored to May High - green line) and got rejected there. It is in line with our expectation of a pullback from the box between 114.7k and 116k. This pullback may end as a higher low or may sweep the lows likely at the extension level between 111,250 and 111,550. Let's jump in for our weekly plan 👇

We had a very narrow Monday Range so we will be looking for confluence with the higher timeframes. The .114-.214 extensions are too c

Bitcoin initially got rejected in the -0.114 - -0.214 extension of the weekend range and then went higher to the Anchored VWAP +1stdev (anchored to May High - green line) and got rejected there. It is in line with our expectation of a pullback from the box between 114.7k and 116k. This pullback may end as a higher low or may sweep the lows likely at the extension level between 111,250 and 111,550. Let's jump in for our weekly plan 👇

We had a very narrow Monday Range so we will be looking for confluence with the higher timeframes. The .114-.214 extensions are too c

- Reward

- like

- Comment

- Repost

- Share

Timing the Cycle - #BTC# #ETH# & #Altcoins#

Although there are people who always believe that "this time it is different", history often rhymes even if it doesn't repeat itself. Adoption makes assets less volatile and also makes them obey to the "law of diminishing returns", but cyclical assets like Bitcoin and altcoins don't lose their cyclical nature easily. So, let's jump in to see what awaits us. 👇

The 2017 Cycle

Bitcoin's cycle bottom was on January 14th, 2025 and cycle top was on December 17th, 2017. It tooks 1068 days from the cycle bottom to the top.

Ethereum topped on January 13th,

Although there are people who always believe that "this time it is different", history often rhymes even if it doesn't repeat itself. Adoption makes assets less volatile and also makes them obey to the "law of diminishing returns", but cyclical assets like Bitcoin and altcoins don't lose their cyclical nature easily. So, let's jump in to see what awaits us. 👇

The 2017 Cycle

Bitcoin's cycle bottom was on January 14th, 2025 and cycle top was on December 17th, 2017. It tooks 1068 days from the cycle bottom to the top.

Ethereum topped on January 13th,

- Reward

- like

- Comment

- Repost

- Share

#BTC# Quick Update

We are inside the box - LTF supply zone - I mentioned in the previous update which is between 114.7k and 116k. As we are fresh out of the weekend and we left weekend lows behind, this is the zone I will hedge my long positions and be careful in.

On the first try, BTC failed to break above the VWAP anchored to the last high before the drop, now it is above it. 115.1k - 115.4k is the extension of the weekend range. There is the 1 std deviation higher extension of the VWAP anchored to the range low (98k) at 115.7k. This VWAP worked as a support before, so it will likely work as

We are inside the box - LTF supply zone - I mentioned in the previous update which is between 114.7k and 116k. As we are fresh out of the weekend and we left weekend lows behind, this is the zone I will hedge my long positions and be careful in.

On the first try, BTC failed to break above the VWAP anchored to the last high before the drop, now it is above it. 115.1k - 115.4k is the extension of the weekend range. There is the 1 std deviation higher extension of the VWAP anchored to the range low (98k) at 115.7k. This VWAP worked as a support before, so it will likely work as

- Reward

- like

- Comment

- Repost

- Share

#BTC# Quick Update

We are inside the box - LTF supply zone - I mentioned in the previous update which is between 114.7k and 116k. As we are fresh out of the weekend and we left weekend lows behind, this is the zone I will hedge my long positions and be careful in.

On the first try, BTC failed to break above the VWAP anchored to the last high before the drop, now it is above it. 115.1k - 115.4k is the extension of the weekend range. There is the 1 std deviation higher extension of the VWAP anchored to the range low (98k) at 115.7k. This VWAP worked as a support before, so it will likely work as

We are inside the box - LTF supply zone - I mentioned in the previous update which is between 114.7k and 116k. As we are fresh out of the weekend and we left weekend lows behind, this is the zone I will hedge my long positions and be careful in.

On the first try, BTC failed to break above the VWAP anchored to the last high before the drop, now it is above it. 115.1k - 115.4k is the extension of the weekend range. There is the 1 std deviation higher extension of the VWAP anchored to the range low (98k) at 115.7k. This VWAP worked as a support before, so it will likely work as

- Reward

- like

- Comment

- Repost

- Share

#BTC# Quick Update

We are inside the box - LTF supply zone - I mentioned in the previous update which is between 114.7k and 116k. As we are fresh out of the weekend and we left weekend lows behind, this is the zone I will hedge my long positions and be careful in.

On the first try, BTC failed to break above the VWAP anchored to the last high before the drop, now it is above it. 115.1k - 115.4k is the extension of the weekend range. There is the 1 std deviation higher extension of the VWAP anchored to the range low (98k) at 115.7k. This VWAP worked as a support before, so it will likely work as

We are inside the box - LTF supply zone - I mentioned in the previous update which is between 114.7k and 116k. As we are fresh out of the weekend and we left weekend lows behind, this is the zone I will hedge my long positions and be careful in.

On the first try, BTC failed to break above the VWAP anchored to the last high before the drop, now it is above it. 115.1k - 115.4k is the extension of the weekend range. There is the 1 std deviation higher extension of the VWAP anchored to the range low (98k) at 115.7k. This VWAP worked as a support before, so it will likely work as

- Reward

- like

- Comment

- Repost

- Share

#BTC# Update

Bitcoin pulled back until the previous ATH at 112k and did a full-retest. The zone between 112k and 116k was never traded other than wicks, so when 116k was lost as support, 112k was imminent.

Now, the zone between 114.7k and 116k will act as an LTF resistance. So when the price goes into that range, it is a good practice to take profits from our weekend longs and expect another visit to the weekend lows, and possibly into the box below the lows between 110.7k and 112k to go full long this time. 110.7k is the EQ of the 98k-123k range and also the lower high below the previous ATH

Bitcoin pulled back until the previous ATH at 112k and did a full-retest. The zone between 112k and 116k was never traded other than wicks, so when 116k was lost as support, 112k was imminent.

Now, the zone between 114.7k and 116k will act as an LTF resistance. So when the price goes into that range, it is a good practice to take profits from our weekend longs and expect another visit to the weekend lows, and possibly into the box below the lows between 110.7k and 112k to go full long this time. 110.7k is the EQ of the 98k-123k range and also the lower high below the previous ATH

- Reward

- like

- 1

- Repost

- Share

GateUser-6ca2d9f8 :

:

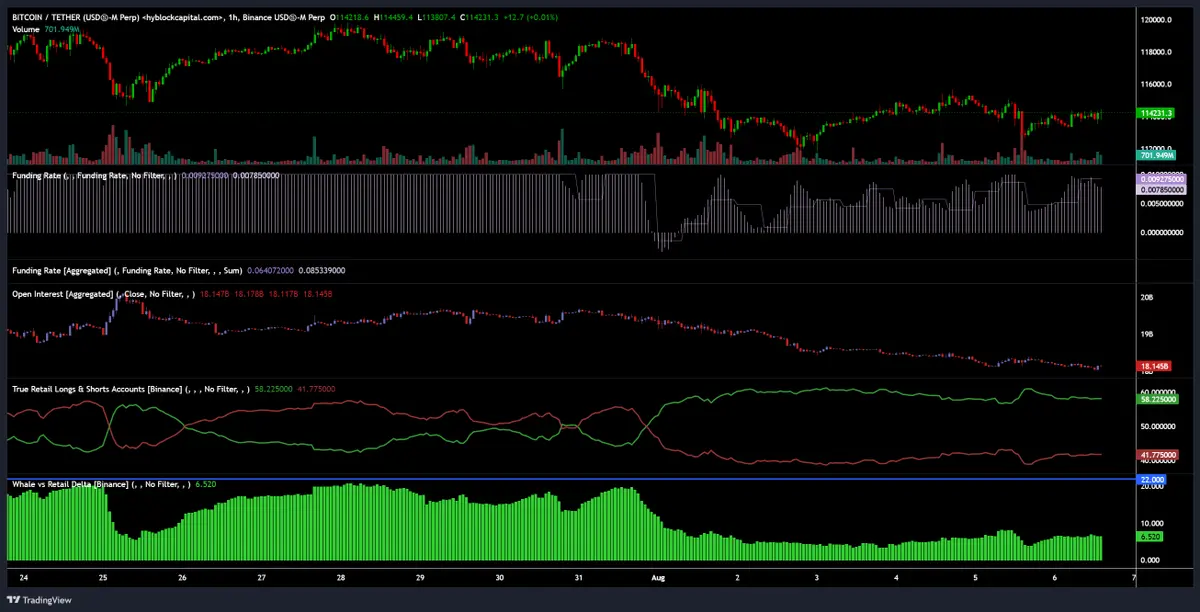

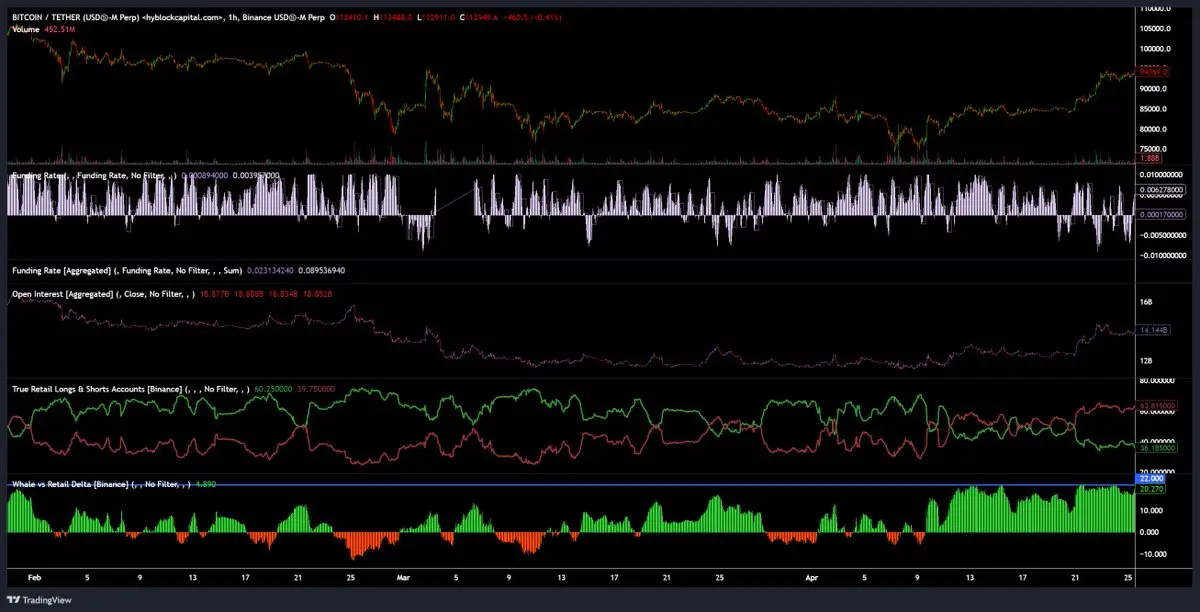

August bullish! #BTC# - a look at some specific metrics

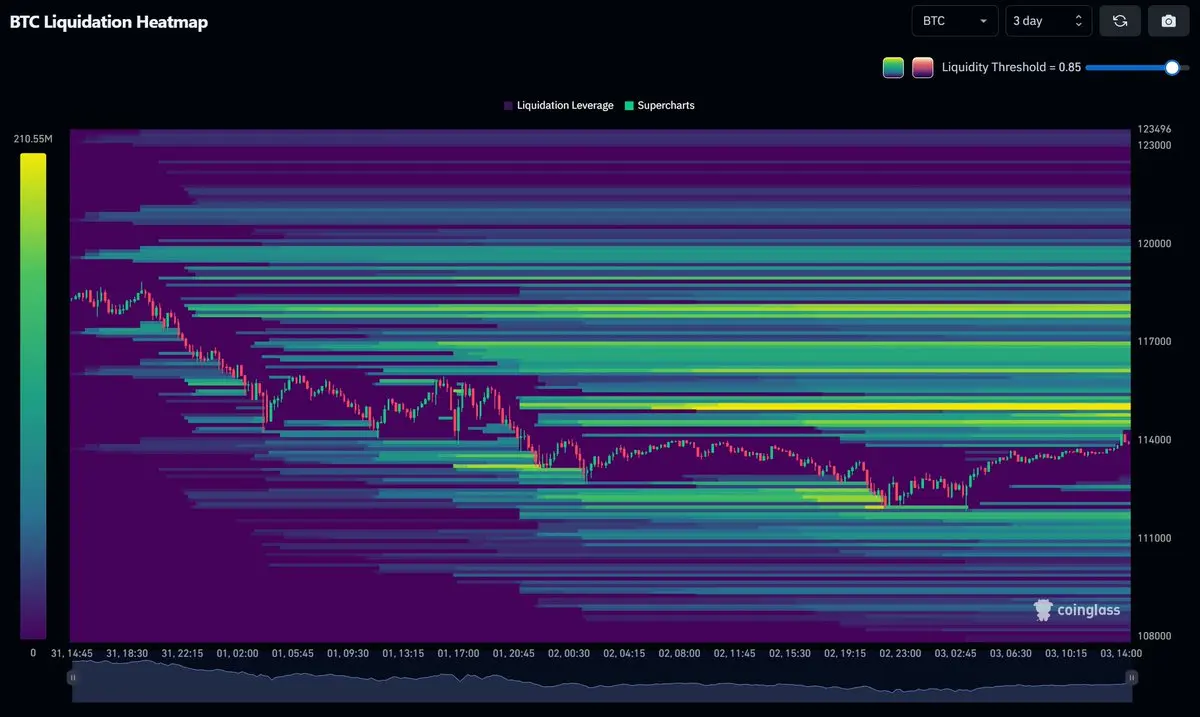

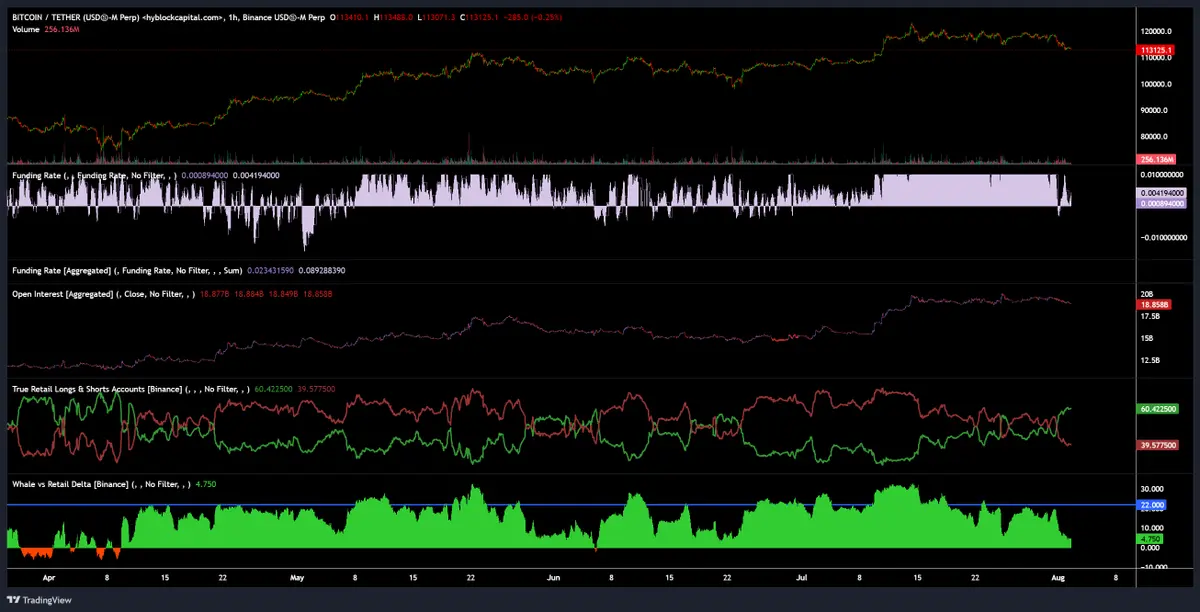

Since April, Retail Long accounts ratio never went above 60%.

- On the 6th of June, as BTC dropped to 100.3k, Whale vs Retail Delta briefly went negative and Retail Long Ratio was at 60.05%. Funding rate was negative during the dip.

-On the 22nd of June, while BTC dipped to 98k, Whale vs Retail Delta was at 4.95 and Long Ratio was at 55.25% - down from 56.9% a day before. Funding rate was negative during the dip.

Today, Funding Rate is slightly positive below the neutral rate, Delta is at 4.80 and Long Ratio is at 60.25%. If we assume that we are in the

Since April, Retail Long accounts ratio never went above 60%.

- On the 6th of June, as BTC dropped to 100.3k, Whale vs Retail Delta briefly went negative and Retail Long Ratio was at 60.05%. Funding rate was negative during the dip.

-On the 22nd of June, while BTC dipped to 98k, Whale vs Retail Delta was at 4.95 and Long Ratio was at 55.25% - down from 56.9% a day before. Funding rate was negative during the dip.

Today, Funding Rate is slightly positive below the neutral rate, Delta is at 4.80 and Long Ratio is at 60.25%. If we assume that we are in the

- Reward

- like

- Comment

- Repost

- Share

#BTC# Update

If you have been following me closely, this correction was long-awaited. There is always a "real" reason for the drop. This time it was the FOMC, tariffs, jobs report and the drop in US stocks.

I may have entered the long prematurely at 114,250 but it is still good to go.

Our first golden pocket was between 113,650 and 114,700 and the other possibility which I regarded as less likely was a re-visit to the May high at 111,700.

So far, BTC has dropped down to 112,690. At the 0.382 level (113,650) we also have the channel bottom and at 113,300 we also have the VWAP anchored to the l

If you have been following me closely, this correction was long-awaited. There is always a "real" reason for the drop. This time it was the FOMC, tariffs, jobs report and the drop in US stocks.

I may have entered the long prematurely at 114,250 but it is still good to go.

Our first golden pocket was between 113,650 and 114,700 and the other possibility which I regarded as less likely was a re-visit to the May high at 111,700.

So far, BTC has dropped down to 112,690. At the 0.382 level (113,650) we also have the channel bottom and at 113,300 we also have the VWAP anchored to the l

- Reward

- like

- Comment

- Repost

- Share

#BTC# Update

We are finally in the long-awaited pocket between 113,650 and 114,700. Are we done with the pullback? Most likely, or almost. Surely a bottom is forming here but BTC may sweep lower until ~113,500 before the bottom is in. If you are not long yet, each drop to 114k is your chance to get on board.

This is all happening while the sentiment is terrible and everyone is expecting lower.

Funding rate briefly went negative and is still below the neutral rate.

Whale vs Retail Delta is at the lows.

BTC.D is back at 62%. It can wick higher before going lower.

We have the last bit of uncert

We are finally in the long-awaited pocket between 113,650 and 114,700. Are we done with the pullback? Most likely, or almost. Surely a bottom is forming here but BTC may sweep lower until ~113,500 before the bottom is in. If you are not long yet, each drop to 114k is your chance to get on board.

This is all happening while the sentiment is terrible and everyone is expecting lower.

Funding rate briefly went negative and is still below the neutral rate.

Whale vs Retail Delta is at the lows.

BTC.D is back at 62%. It can wick higher before going lower.

We have the last bit of uncert

- Reward

- like

- Comment

- Repost

- Share

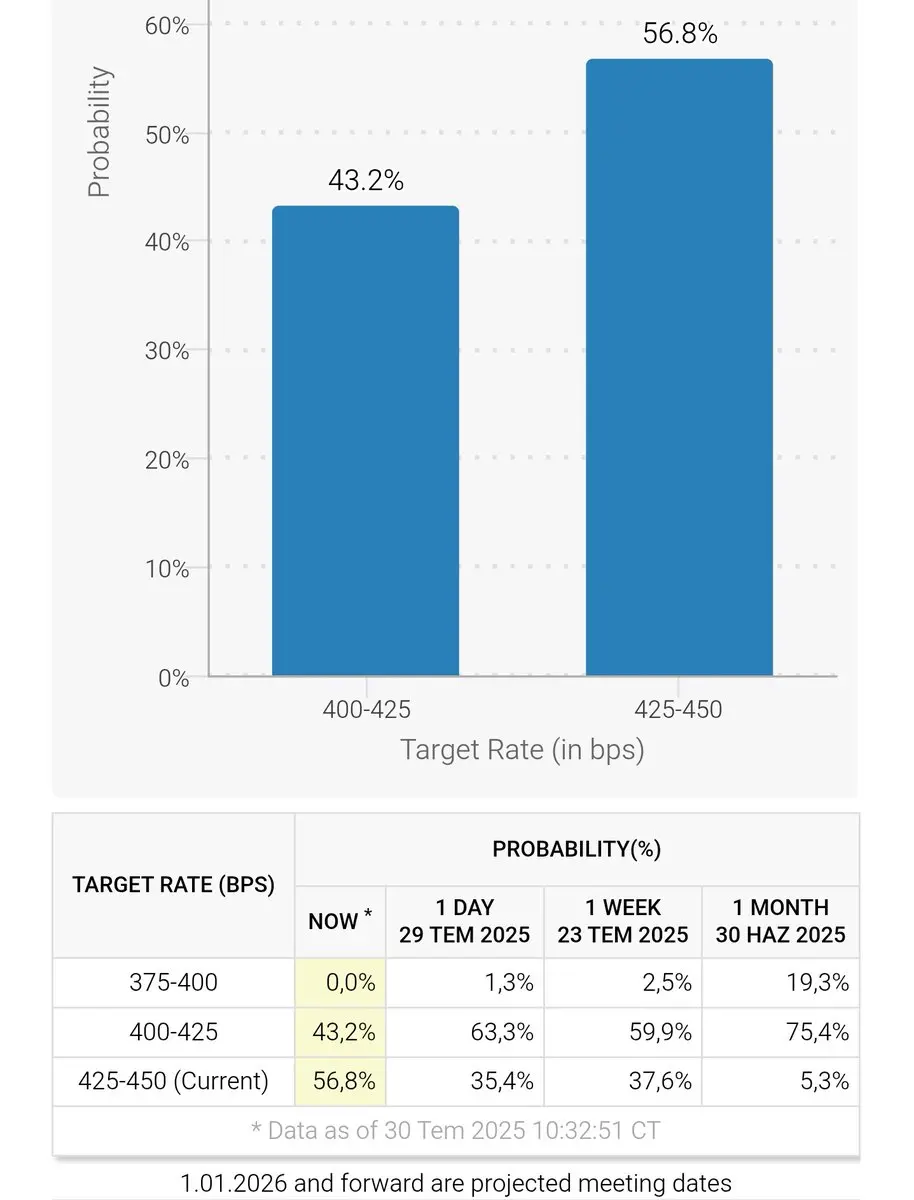

#BTC# Update

Today we had the FOMC interest rate decision and Press Conference. While many people were expecting some dovish signals from Powell including a hint at rate cuts in September, Powell was more hawkish than expected, underlining the need for more data to assess the effects of the tariffs.

Bitcoin didn't do anything crazy but only pulled back until the -0.618 extension of the Monday Range.

Meanwhile, Microsoft and Meta released their earnings reports showing that they strongly exceeded the expectations. Hence the market recovered.

Now we have a 43.2% of a rate cut expectation in the

Today we had the FOMC interest rate decision and Press Conference. While many people were expecting some dovish signals from Powell including a hint at rate cuts in September, Powell was more hawkish than expected, underlining the need for more data to assess the effects of the tariffs.

Bitcoin didn't do anything crazy but only pulled back until the -0.618 extension of the Monday Range.

Meanwhile, Microsoft and Meta released their earnings reports showing that they strongly exceeded the expectations. Hence the market recovered.

Now we have a 43.2% of a rate cut expectation in the

- Reward

- like

- Comment

- Repost

- Share

Market HTF Update

On July 1st, I posted an analysis about BoJ interest rates (see first comment for the link) and talked about why there could be a correction at the beginning of August after a run in July. We had a decent run in July. HOWEVER, I don't think it is complete yet. Let me open it up. 👇

BoJ Rate Hike

Now that the elections are over, Bank of Japan only needs to focus on data to hike rates. Most analysts agree that a rate hike at this point would be too early. Although they see rate hikes possible, it is not expected until the October or December 2025 meetings. They first need a

On July 1st, I posted an analysis about BoJ interest rates (see first comment for the link) and talked about why there could be a correction at the beginning of August after a run in July. We had a decent run in July. HOWEVER, I don't think it is complete yet. Let me open it up. 👇

BoJ Rate Hike

Now that the elections are over, Bank of Japan only needs to focus on data to hike rates. Most analysts agree that a rate hike at this point would be too early. Although they see rate hikes possible, it is not expected until the October or December 2025 meetings. They first need a

- Reward

- like

- Comment

- Repost

- Share