CoinWorldKing

No content yet

CoinWorldKing

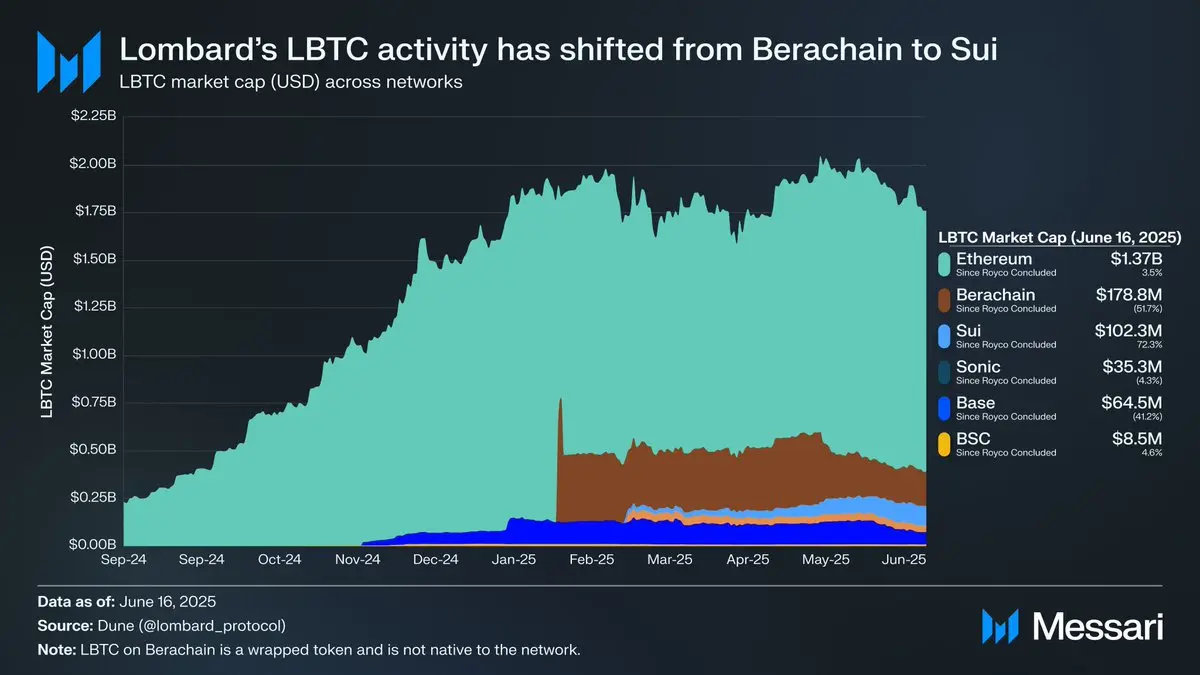

Recently, I have been observing the liquidity changes of Lombard Finance. Since the Royco Protocol opened withdrawals on May 6, the flow of funds has been particularly fast!

A quite obvious phenomenon:

The supply of LBTC on Berachain has been cut in half, decreasing by 52%, while most has gone to Sui, which instead saw a growth of 72%.

Interestingly, although many people think that Sui might be a poor chain (low TVL, relatively young ecosystem), its DeFi yields are actually quite considerable. If you were originally looking to earn Sats (Satlayer Points) and Lux (Lombard Points), Sui is basica

View OriginalA quite obvious phenomenon:

The supply of LBTC on Berachain has been cut in half, decreasing by 52%, while most has gone to Sui, which instead saw a growth of 72%.

Interestingly, although many people think that Sui might be a poor chain (low TVL, relatively young ecosystem), its DeFi yields are actually quite considerable. If you were originally looking to earn Sats (Satlayer Points) and Lux (Lombard Points), Sui is basica

- Reward

- like

- 1

- Share

ZulfiqarMayo :

:

wow that's amazing news about the project dear friendTheoriq has appeared on Coingecko, although it is still marked as Preview Only.

But it can be seen that they are slowly stepping onto the stage. There is no fanfare, just a quiet launch. From Agent Swarm to the OLP system, the path is clear, the pace is steady, and everything is proceeding according to plan!

The specific results of the public sale distribution will be announced tomorrow, and Coingecko has also launched on time. Next, we will see when they will light up the token page and whether the actual performance will keep up!

I just received the public round pre-sale emails sent by Kaito

View OriginalBut it can be seen that they are slowly stepping onto the stage. There is no fanfare, just a quiet launch. From Agent Swarm to the OLP system, the path is clear, the pace is steady, and everything is proceeding according to plan!

The specific results of the public sale distribution will be announced tomorrow, and Coingecko has also launched on time. Next, we will see when they will light up the token page and whether the actual performance will keep up!

I just received the public round pre-sale emails sent by Kaito

- Reward

- 1

- Comment

- Share

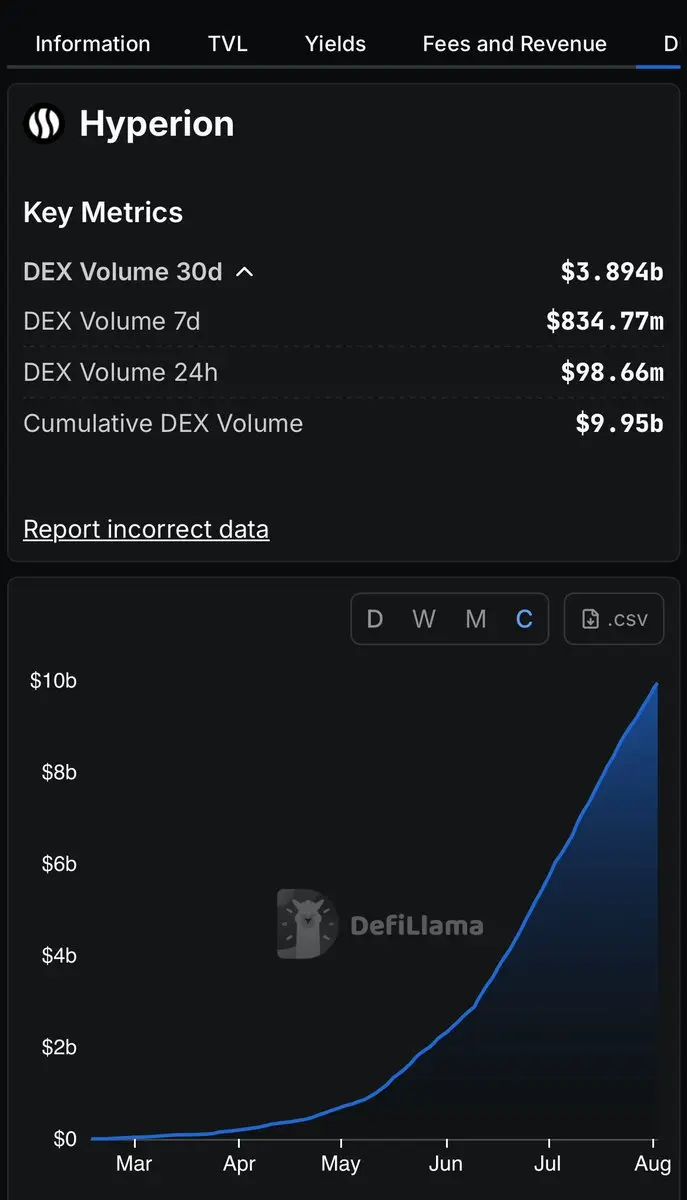

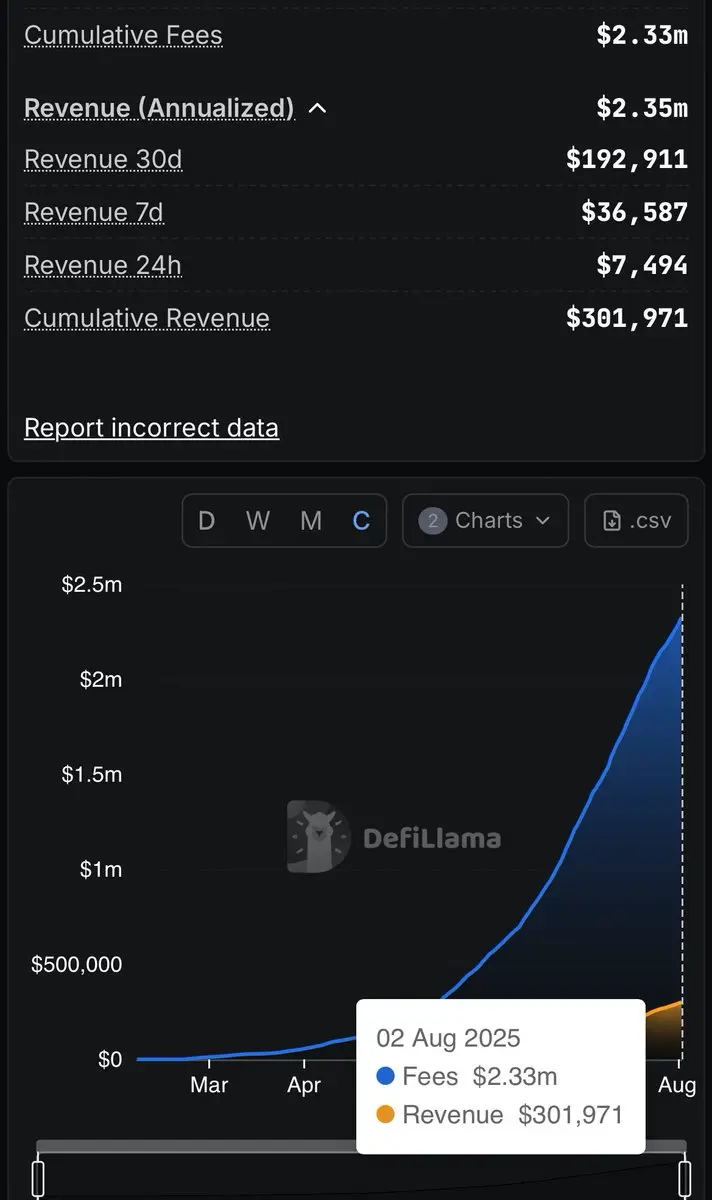

I recently looked through Hyperion's data, it's quite interesting:

The DEX trading volume in 30 days is close to 3.9 billion USD, almost reaching 10 billion, and it's running incredibly fast!

But if you look at the income distribution again:

※ Cumulative Fees: $2.33m

※ Cumulative Revenue: $301,971

That is to say, the transaction fees earned are substantial, but the proportion of income retained by the platform is actually not high.

This discrepancy can explain quite a bit:

The trading volume is very large, the trading depth is sufficient, and the fee model tends to give a larger share to LPs.

View OriginalThe DEX trading volume in 30 days is close to 3.9 billion USD, almost reaching 10 billion, and it's running incredibly fast!

But if you look at the income distribution again:

※ Cumulative Fees: $2.33m

※ Cumulative Revenue: $301,971

That is to say, the transaction fees earned are substantial, but the proportion of income retained by the platform is actually not high.

This discrepancy can explain quite a bit:

The trading volume is very large, the trading depth is sufficient, and the fee model tends to give a larger share to LPs.

- Reward

- like

- Comment

- Share

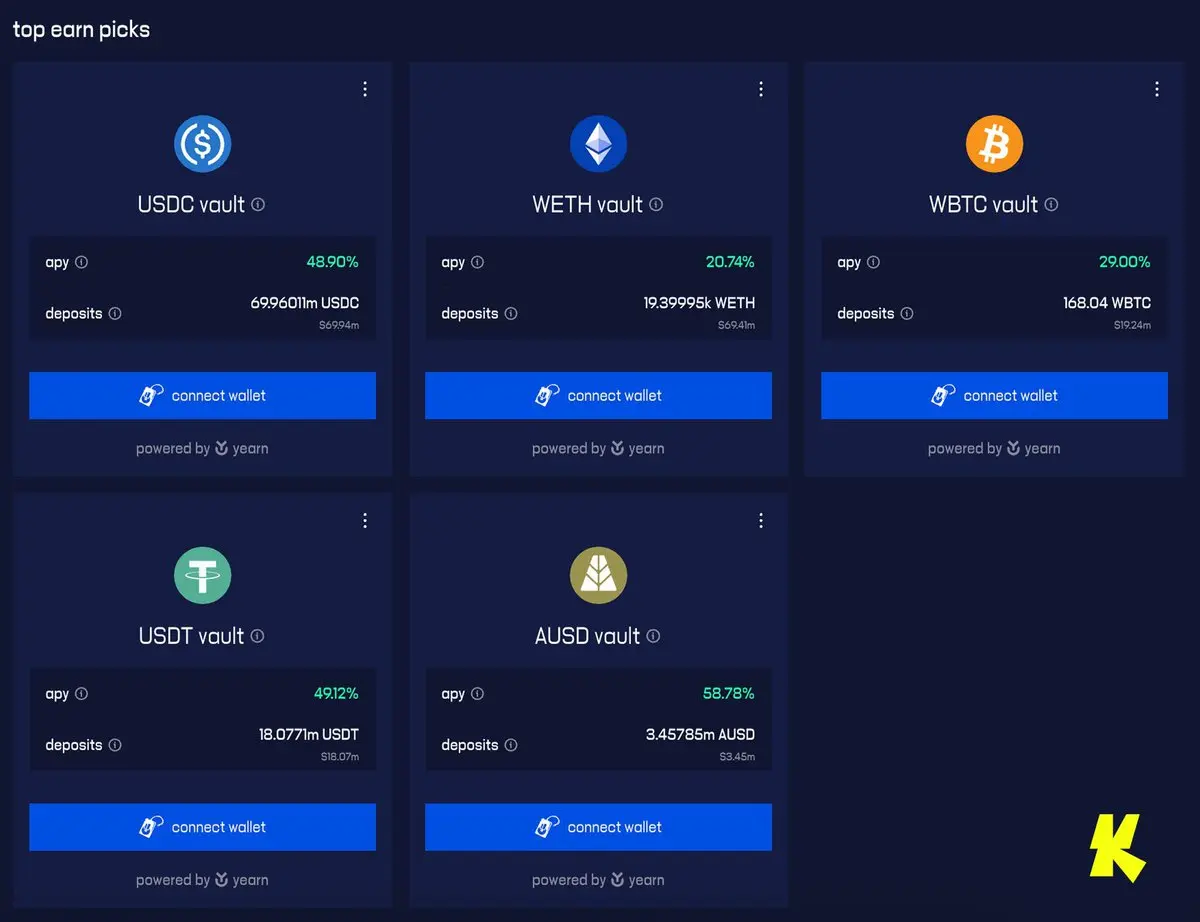

Recently, while browsing Twitter, I saw a foreign DeFi blogger talking about Katana, claiming that it is a project that offers up to 48% annual interest rate on USDT/USDC before its TGE, with the condition that funds must be locked until before 2026. Although it sounds a bit crazy, I am indeed intrigued and casually looked through the content that Lombard had posted before, and found that they have a close relationship with Katana!

In simple terms, this is not just another cross-chain integration of BTC. Lombard has directly become the only BTC issuer on Katana, with two new assets added:

※ BT

View OriginalIn simple terms, this is not just another cross-chain integration of BTC. Lombard has directly become the only BTC issuer on Katana, with two new assets added:

※ BT

- Reward

- like

- Comment

- Share

Defi App V2 is about to launch!

This time it's serious! Let's upgrade the experience again! The Dapp will be faster, more stable, multi-chain, able to create contracts, and generate profits. The key point is that it supports mobile natively, not some half-baked H5!

It was only usable before, but now it can truly serve as a main app!

I have set a reminder, waiting for it to go live 🔔

#KaitoYap# @KaitoAI @defidotapp #Yap# $HOME @doranmaul

View OriginalThis time it's serious! Let's upgrade the experience again! The Dapp will be faster, more stable, multi-chain, able to create contracts, and generate profits. The key point is that it supports mobile natively, not some half-baked H5!

It was only usable before, but now it can truly serve as a main app!

I have set a reminder, waiting for it to go live 🔔

#KaitoYap# @KaitoAI @defidotapp #Yap# $HOME @doranmaul

- Reward

- 3

- 2

- Share

Li44 :

:

Hold on tight 💪View More

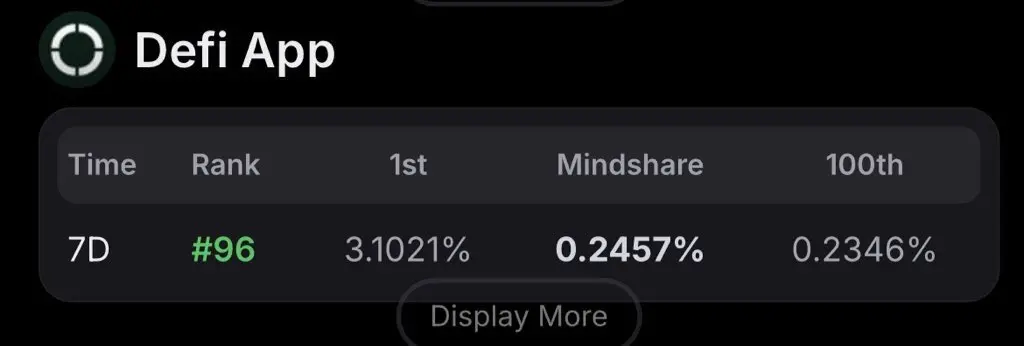

DeFi App 7D has finally made the list! That means 30D is also about to follow!

This article is to share what the DeFi App has wanted to do from the very beginning:

Make Decentralized Finance simpler!

It's not about being innovative or creating a gimmick, but rather asking an old question:

"It's already 2025, why is DeFi still so hard to use?"

Creating a wallet requires managing gas, bridging, selecting routes, and distinguishing between different chains, wrapped or unwrapped. How can an ordinary person understand all this?

Old users are too lazy to mess around, let alone newcomers! So they sim

View OriginalThis article is to share what the DeFi App has wanted to do from the very beginning:

Make Decentralized Finance simpler!

It's not about being innovative or creating a gimmick, but rather asking an old question:

"It's already 2025, why is DeFi still so hard to use?"

Creating a wallet requires managing gas, bridging, selecting routes, and distinguishing between different chains, wrapped or unwrapped. How can an ordinary person understand all this?

Old users are too lazy to mess around, let alone newcomers! So they sim

- Reward

- like

- Comment

- Share

Decentralized Finance App 7D has finally made the list! That means 30D is also almost there!

This article is to share what the DeFi App has wanted to do from the very beginning:

Make DeFi simpler!

It's not about innovation or gimmicks, but rather asking an old question:

"It's already 2025, why is DeFi still so difficult to use?"

Creating a wallet requires managing gas, bridging back and forth, selecting routes, and also distinguishing between which chain, wrapped or not wrapped. How can an ordinary person understand all this?

Old users are too lazy to mess around, let alone new ones! So they s

View OriginalThis article is to share what the DeFi App has wanted to do from the very beginning:

Make DeFi simpler!

It's not about innovation or gimmicks, but rather asking an old question:

"It's already 2025, why is DeFi still so difficult to use?"

Creating a wallet requires managing gas, bridging back and forth, selecting routes, and also distinguishing between which chain, wrapped or not wrapped. How can an ordinary person understand all this?

Old users are too lazy to mess around, let alone new ones! So they s

- Reward

- like

- Comment

- Share

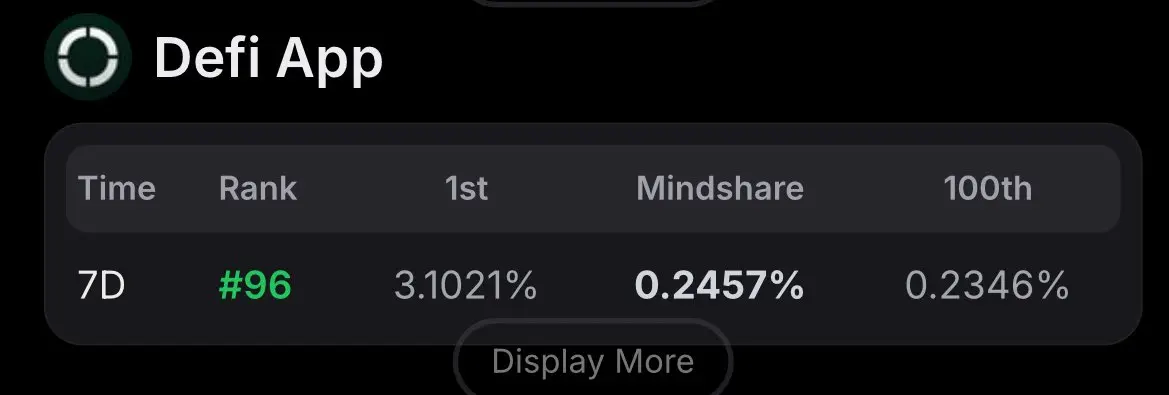

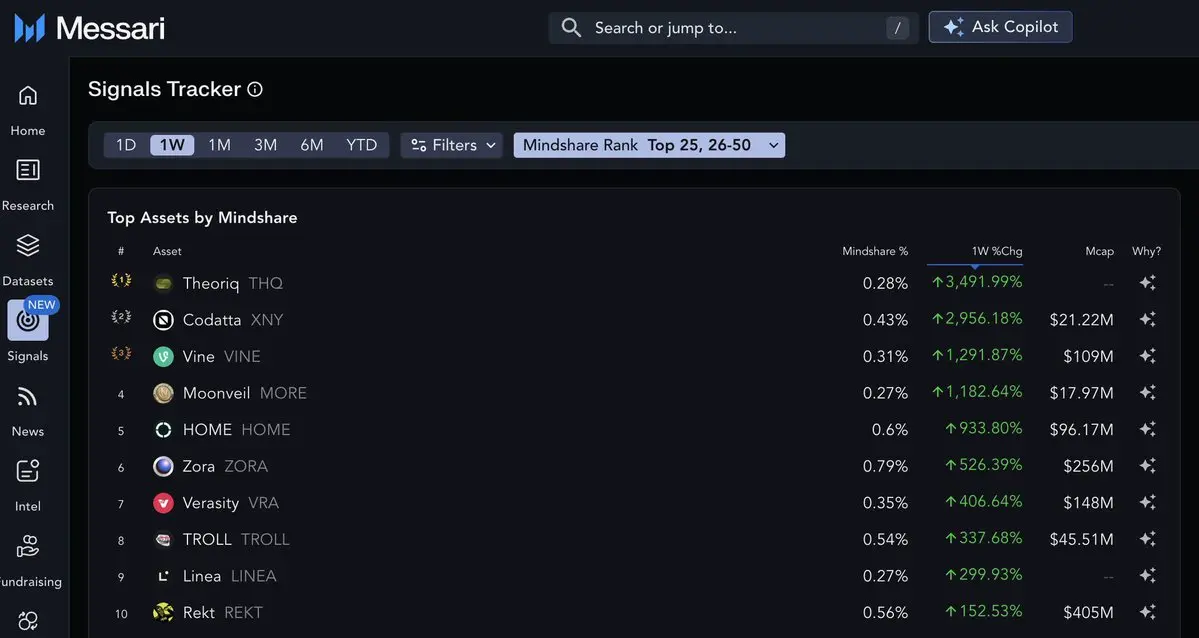

Who is on the Messari Hot List?

The one that ranks first is Theoriq! Kaito's new offering just ended, with subscriptions exceeding 39 times, directly topping the mindshare growth leaderboard within 7 days.

Everyone says there is no money, but 78M has rushed in! Now everyone on the internet knows about it, right? Everyone should take a serious look at this project! Whether to participate in the new offering is another matter, but the hype has truly taken off!

On the other hand, there is more than one that has surged the most on Messari. The DeFidot App has risen by 930% in the past 7 days, with

View OriginalThe one that ranks first is Theoriq! Kaito's new offering just ended, with subscriptions exceeding 39 times, directly topping the mindshare growth leaderboard within 7 days.

Everyone says there is no money, but 78M has rushed in! Now everyone on the internet knows about it, right? Everyone should take a serious look at this project! Whether to participate in the new offering is another matter, but the hype has truly taken off!

On the other hand, there is more than one that has surged the most on Messari. The DeFidot App has risen by 930% in the past 7 days, with

- Reward

- like

- Comment

- Share

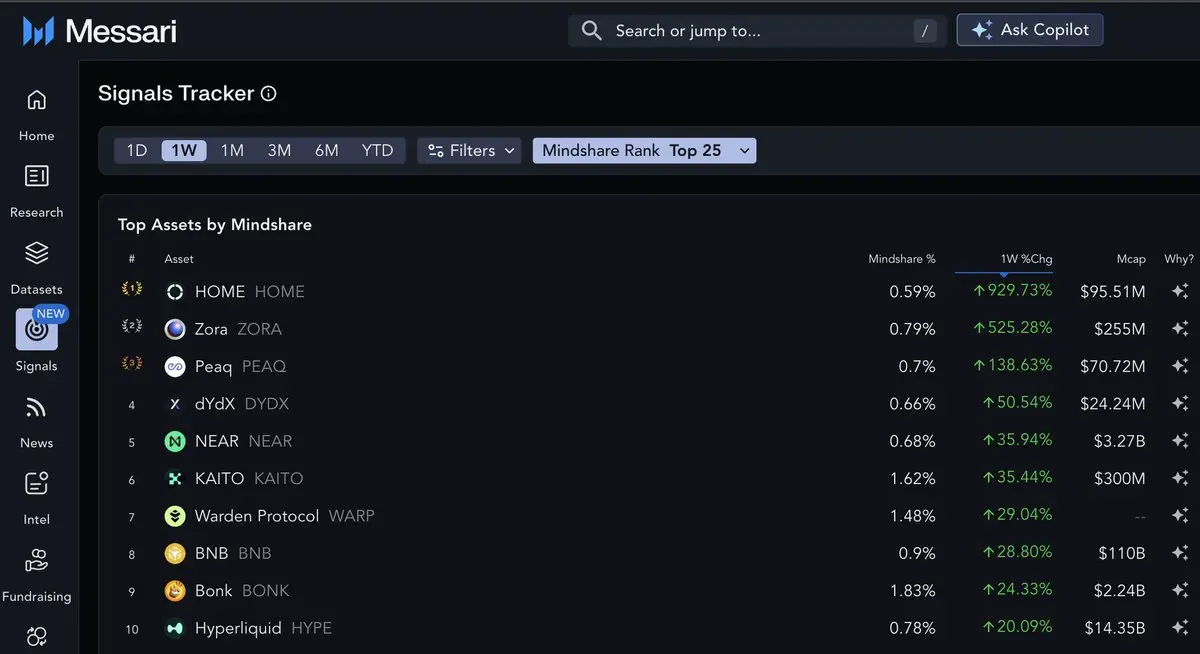

Last night, when the founder of Hana said that the TGE would be delayed until after the Mainnet launch, Capsule's NFT plummeted by 40%, dropping from a high of 65U to around 40U now...

The sentiment in the community is indeed a bit collapsing; it feels like many people came for the short-term rhythm, and now that the TGE has been delayed, the sentiment has also receded.

But that being said, is this price worth it?

To be honest, if you were already optimistic about Hana, this is actually a very practical question:

Are you willing to pick up chips when others are in panic, and reap rewards when

The sentiment in the community is indeed a bit collapsing; it feels like many people came for the short-term rhythm, and now that the TGE has been delayed, the sentiment has also receded.

But that being said, is this price worth it?

To be honest, if you were already optimistic about Hana, this is actually a very practical question:

Are you willing to pick up chips when others are in panic, and reap rewards when

View Original

- Reward

- like

- Comment

- Share

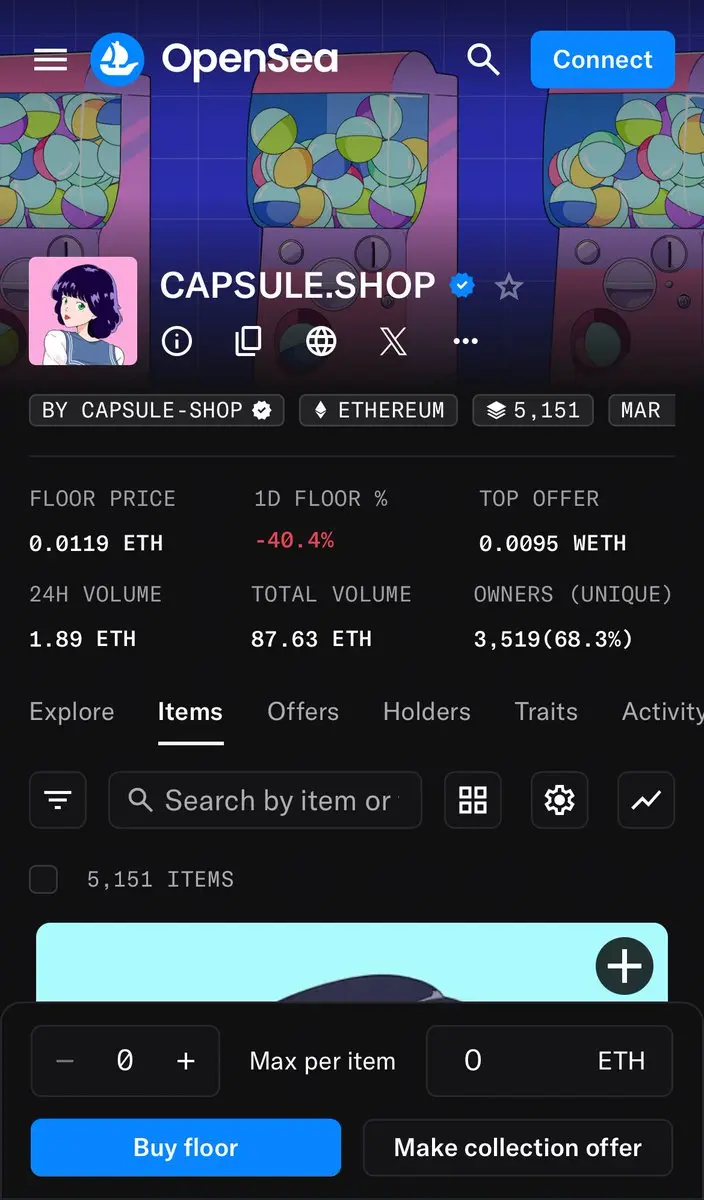

How to play Orderly ecosystem most cost-effectively?

After my research, there are roughly two paths:

1|Unstake $ORDER to get Valor

It's like you subscribed to Orderly's dividend ticket, and you get a share of the project's earnings. An annualized return of 13.47%, effortlessly and steadily earning.

2|Directly throw USDC into OmniVault

Even if you don't understand trading, you can be a behind-the-scenes LP. The platform uses your money for market making, collects fees, and conducts settlements, and you share in the profits. It's hassle-free, with an annualized return of 23%, but the earnings ma

After my research, there are roughly two paths:

1|Unstake $ORDER to get Valor

It's like you subscribed to Orderly's dividend ticket, and you get a share of the project's earnings. An annualized return of 13.47%, effortlessly and steadily earning.

2|Directly throw USDC into OmniVault

Even if you don't understand trading, you can be a behind-the-scenes LP. The platform uses your money for market making, collects fees, and conducts settlements, and you share in the profits. It's hassle-free, with an annualized return of 23%, but the earnings ma

ORDER-3.2%

- Reward

- like

- Comment

- Share

How does LBTC ensure Bitcoin asset security?

Minting requires two locks, and the security system of Lombard Protocol has a special design called Bascule Drawbridge. The name may sound confusing at first, but what it does is actually quite simple: when minting LBTC across chains, an entirely independent confirmation mechanism is added.

Many bridge protocols encounter issues because one system has the final say. Once compromised, everything goes out of control. Lombard does not do this; it splits verification into two paths: one is the Security Consortium, and the other is the Bascule Drawbridge

Minting requires two locks, and the security system of Lombard Protocol has a special design called Bascule Drawbridge. The name may sound confusing at first, but what it does is actually quite simple: when minting LBTC across chains, an entirely independent confirmation mechanism is added.

Many bridge protocols encounter issues because one system has the final say. Once compromised, everything goes out of control. Lombard does not do this; it splits verification into two paths: one is the Security Consortium, and the other is the Bascule Drawbridge

BTC-1.17%

- Reward

- like

- Comment

- Share

When you trade contracts on Orderly, do you know who is feeding you the prices? It's @PythNetwork!

This is not randomly selected by the oracle, but rather the kind of accuracy that can provide you with speed, precision, and stability. Now on-chain transactions are getting closer to CEX, and it relies on such details behind it:

※ Reliable feeding price is Pyth's matter.

Fast matching is what Orderly does.

The combination of both ensures that one won't be wiped out by slippage when going long or get liquidated due to oracle fluctuations.

▰▰▰▰▰▰

Why is it so important?

Many people create strategi

View OriginalThis is not randomly selected by the oracle, but rather the kind of accuracy that can provide you with speed, precision, and stability. Now on-chain transactions are getting closer to CEX, and it relies on such details behind it:

※ Reliable feeding price is Pyth's matter.

Fast matching is what Orderly does.

The combination of both ensures that one won't be wiped out by slippage when going long or get liquidated due to oracle fluctuations.

▰▰▰▰▰▰

Why is it so important?

Many people create strategi

- Reward

- like

- Comment

- Share

XerpaAI is a bit crazy! It wants to eliminate manual deployment 🫡

What XerpaAI aims to do is to completely automate user growth for AI projects. Currently, regardless of how intelligent the model is, AI projects ultimately rely on people to tweet, advertise, and find traffic. But XerpaAI thinks the other way around:

Is it possible for AI to handle even the step of finding users?

So they created the AI Growth Agent, which is simply an AI growth assistant that can automatically identify target users, run growth strategies, and also optimize in real-time based on data.

In the short term, XerpaAI

View OriginalWhat XerpaAI aims to do is to completely automate user growth for AI projects. Currently, regardless of how intelligent the model is, AI projects ultimately rely on people to tweet, advertise, and find traffic. But XerpaAI thinks the other way around:

Is it possible for AI to handle even the step of finding users?

So they created the AI Growth Agent, which is simply an AI growth assistant that can automatically identify target users, run growth strategies, and also optimize in real-time based on data.

In the short term, XerpaAI

- Reward

- like

- Comment

- Share

Orderly has launched multi-collateral Margin, allowing you to directly use the coins you have to open contracts without the need to swap back and forth!

In the past, when making contracts on the blockchain, I would get a headache as soon as I opened a position:

Holding $ETH, $USDT, $USDC, but still having to exchange them into the specified coin to use; when the market comes, just the step of exchanging coins is a bit slow, and there's also an additional transaction fee!

No need to beat around the bush anymore, Orderly now supports multi-collateral Margin, allowing you to open positions direct

View OriginalIn the past, when making contracts on the blockchain, I would get a headache as soon as I opened a position:

Holding $ETH, $USDT, $USDC, but still having to exchange them into the specified coin to use; when the market comes, just the step of exchanging coins is a bit slow, and there's also an additional transaction fee!

No need to beat around the bush anymore, Orderly now supports multi-collateral Margin, allowing you to open positions direct

- Reward

- like

- Comment

- Share

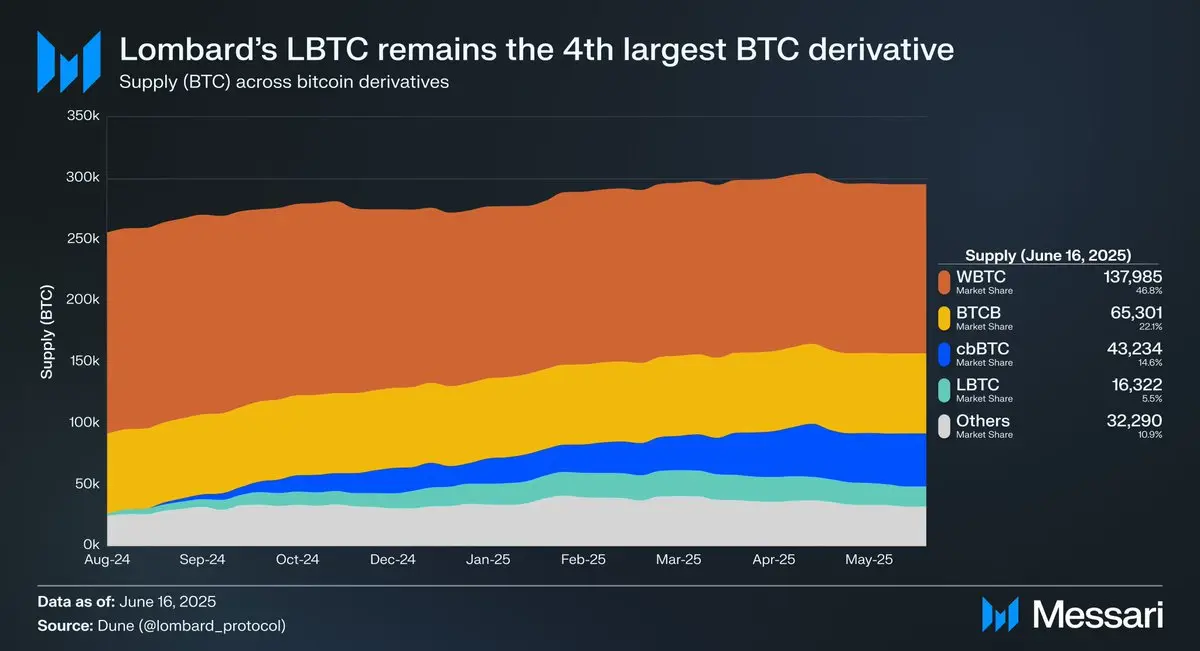

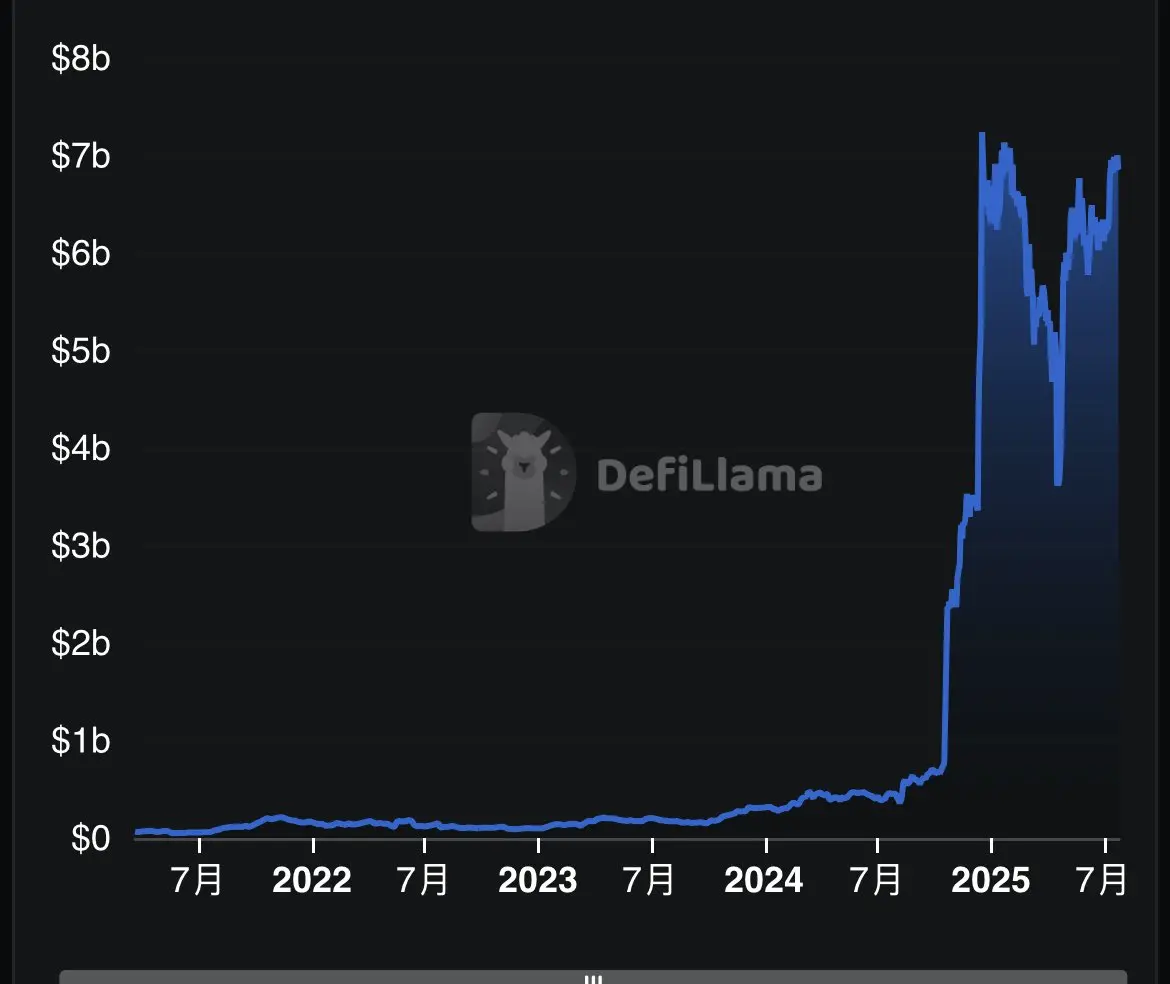

Why am I still firmly optimistic about BTCfi? Even more optimistic about Lombard?

Today, if you only look at TVL, you might think that Bitcoin DeFi is just a niche ecosystem. But when you compare this market with the market capitalization of Bitcoin itself, you will find a huge potential gap, the ratio of BTC DeFi TVL to the network market value:

Ethereum 21.28% |Solana 9.98% | Bitcoin 0.29%

In other words:

※ On Ethereum, for every 5 dollars, 1 dollar is involved in DeFi.

※ On Solana, for every 10 dollars, 1 dollar flows onto the chain.

※ But what about Bitcoin? For every 300 dollars, there is

View OriginalToday, if you only look at TVL, you might think that Bitcoin DeFi is just a niche ecosystem. But when you compare this market with the market capitalization of Bitcoin itself, you will find a huge potential gap, the ratio of BTC DeFi TVL to the network market value:

Ethereum 21.28% |Solana 9.98% | Bitcoin 0.29%

In other words:

※ On Ethereum, for every 5 dollars, 1 dollar is involved in DeFi.

※ On Solana, for every 10 dollars, 1 dollar flows onto the chain.

※ But what about Bitcoin? For every 300 dollars, there is

- Reward

- like

- Comment

- Share