XRP Price Prediction: Ripple Long-Term Target Eyes $20 Amid Regulatory Clarity

Preface

Recently, market momentum has started shifting from Bitcoin to altcoins. Most analysts expect XRP to see a major breakout in the coming months. While its short-term performance has been somewhat lackluster, the medium- and long-term outlook for XRP remains optimistic as major legal risks have been resolved and institutional demand continues to rise.

Legal Barriers Lifted, Renewed Market Confidence

The U.S. Securities and Exchange Commission (SEC) has settled its longstanding lawsuit with Ripple Labs, removing the most critical legal risk for XRP. This development has restored institutional investor interest, with some companies already integrating XRP into their treasury management strategies. Additionally, the market is highly anticipating approval of an XRP ETF. As the regulatory landscape becomes clearer, Ripple plans to accelerate its expansion into international payments and cross-border settlements. This will further strengthen XRP’s status as a mainstream financial instrument.

Long-Term Target: $20

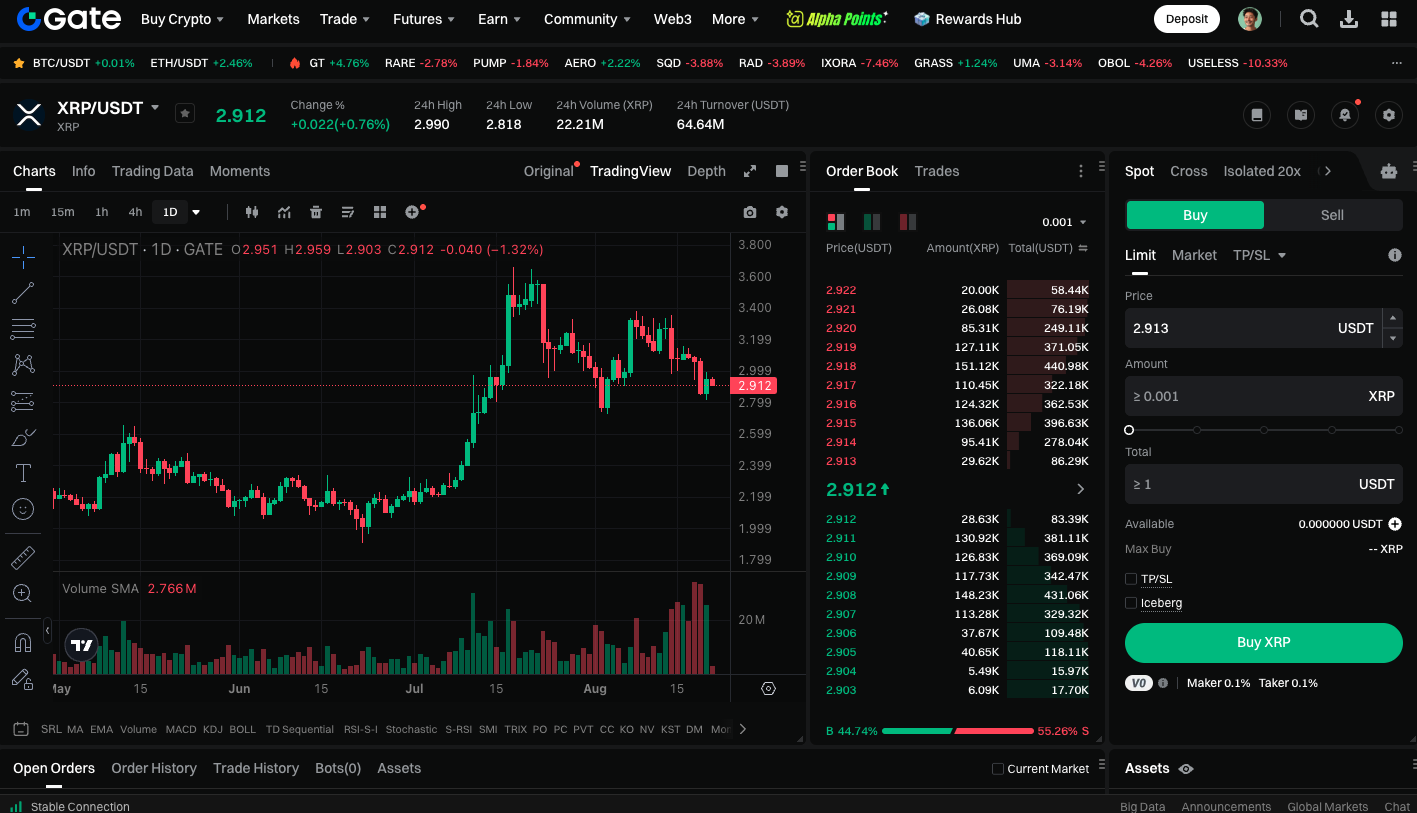

Leading crypto analyst XForceGlobal recently indicated that XRP’s cyclical target remains above $20. As of this writing, XRP is priced at $2.91, so reaching that goal would require an increase of more than sevenfold. He noted that the market is moving from a “confirmation phase” into an “acceptance phase.” This signals that bearish sentiment is subsiding and a bullish outlook is taking over.

However, short-term trading remains challenging. Analyst CryptoWZRD warns that if XRP cannot hold above $3.23, it could fall back into bearish territory.

SolMining: Maximizing XRP Value

With confidence in XRP on the rise, new and innovative use cases for XRP are multiplying in the market. SolMining, for example, enables XRP holders to convert profits into daily returns. The platform leverages green energy and advanced security architecture, eliminating the complexity of traditional mining. By eliminating the complexity of traditional mining, the platform creates a stable and sustainable income source for investors.

Trade XRP spot now: https://www.gate.com/trade/XRP_USDT

Conclusion

In the short term, XRP still must break through the $3.23 resistance level to confirm a renewed upward trend. However, with regulatory risks addressed, growing expectations for an ETF, and increased institutional engagement, the analyst’s long-term target of $20 may be attainable if the market enters a full bull phase.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025