- Topic

26k Popularity

31k Popularity

115k Popularity

3k Popularity

20k Popularity

- Pin

- 🚀 ETH jumped to $4,600 this morning, up 8.69% in 24h!

Just shy of the $4,891 ATH—think it breaks through?

📍 Follow Gate_Square, vote and drop your reason.

🎁 4 winners split $100 Futures Voucher! - 📢 Exclusive on Gate Square — #PROVE Creative Contest# is Now Live!

CandyDrop × Succinct (PROVE) — Trade to share 200,000 PROVE 👉 https://www.gate.com/announcements/article/46469

Futures Lucky Draw Challenge: Guaranteed 1 PROVE Airdrop per User 👉 https://www.gate.com/announcements/article/46491

🎁 Endless creativity · Rewards keep coming — Post to share 300 PROVE!

📅 Event PeriodAugust 12, 2025, 04:00 – August 17, 2025, 16:00 UTC

📌 How to Participate

1.Publish original content on Gate Square related to PROVE or the above activities (minimum 100 words; any format: analysis, tutorial, creativ - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re - 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

Should we prepare children's education funds in the parent's account? Use a minor account? | Let's build assets while saving on taxes | Moneyクリ MoneyX Securities' investment information and media useful for finances

The new NISA (Nippon Individual Savings Account) that started in 2024 is aimed at individuals aged 18 and older living in Japan, and it cannot be used by minors. Additionally, the Junior NISA will be abolished at the end of 2023, and no new investments will be allowed after 2024.

I sometimes receive questions in seminars like, "I would like to invest part of various allowances and New Year's money in an account under my child's name, but where and how should I start?" In such cases, what should I do? There are several options.

1. Invest through the guardian's NISA account and allocate part for educational expenses.

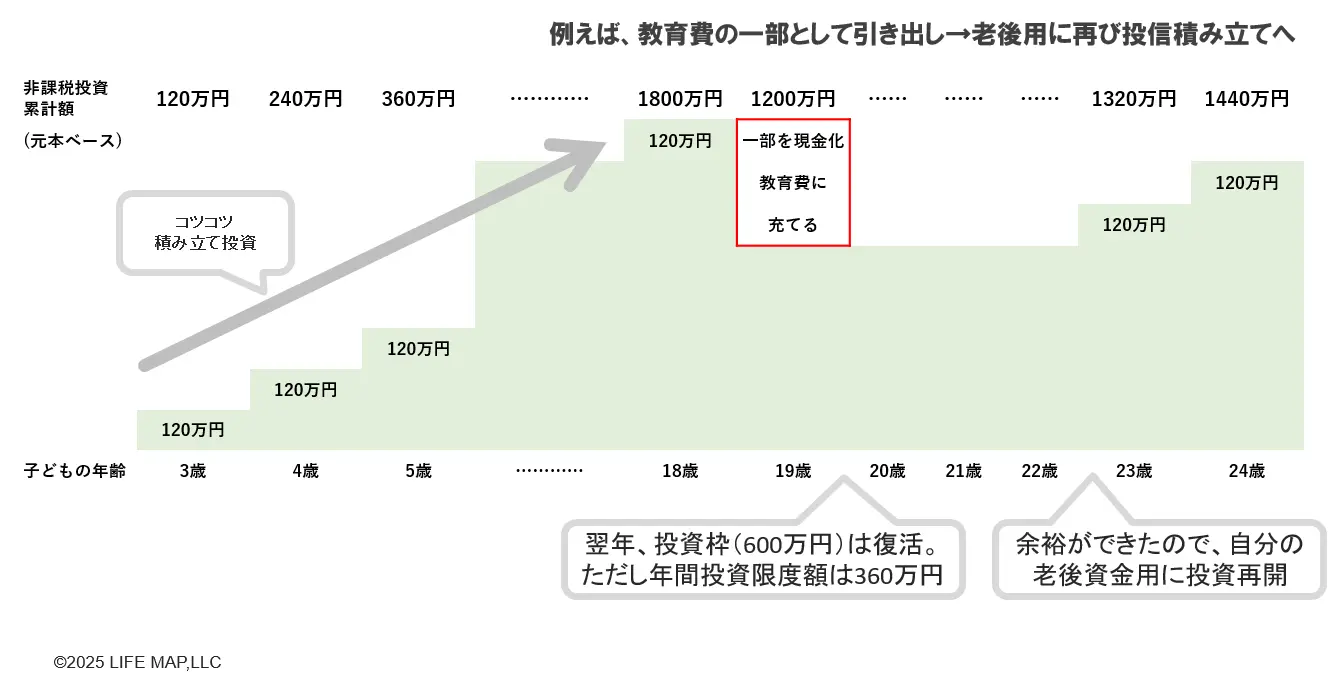

The first method is to take advantage of the increase in the annual investment limit for NISA, which has risen to 3.6 million yen per person per year, by increasing the amount of regular investments in the parent's own NISA account and using part of it for educational expenses. Here are several methods to consider.

①Invest without categorizing by purpose

This is a method of making contributions to an investment without color-coding it as "this is for educational expenses" or similar, by using part of your financial assets or part of your salary. When you need money, you withdraw a portion of the investment. When you have some spare funds, you resume your contributions.

Starting from 2024, even if the total NISA limit of 18 million yen is filled, if a portion is withdrawn, the book value portion will be restored in the following year. Additionally, the amount that can be invested in subsequent years will be within the annual investment limit of 3.6 million yen.

[Figure 1] An example of investing without categorizing by purpose Source: Created by the author

It is reasonable to perform accumulation investment without color-coding for specific purposes and to redeem it when necessary, but there are also voices that hesitate to use it. In that case, it might be a good idea to take methods ② and ③ below.

Source: Created by the author

It is reasonable to perform accumulation investment without color-coding for specific purposes and to redeem it when necessary, but there are also voices that hesitate to use it. In that case, it might be a good idea to take methods ② and ③ below.

Separate into ② accounts (accumulation investment limit and growth investment limit)

For example, you can accumulate your retirement funds by utilizing the "Tsumitate Investment Account" and accumulate investment for your child's education using the "Growth Investment Account." Even if you accumulate the same investment trust, the Tsumitate Investment Account and the Growth Investment Account are separate accounts, allowing you to manage them separately.

[Figure 2] Method of Managing by Account Source: Created by the author

Source: Created by the author

③Divide by product

If you have multiple children, you can save in different products, such as having the eldest daughter invest in Fund A and the second daughter in Fund B.

[Figure 3] Method of categorizing by products Source: Created by the author

However, since you will be buying investment trusts and listed stocks in a NISA account, it is not suitable for funds you plan to use within a few years. However, if your children are still young and you are considering long-term investments looking 10 or 15 years ahead, it can be an option. That said, even in that case, consider combining it with savings accounts and insurance, not just investments.

Source: Created by the author

However, since you will be buying investment trusts and listed stocks in a NISA account, it is not suitable for funds you plan to use within a few years. However, if your children are still young and you are considering long-term investments looking 10 or 15 years ahead, it can be an option. That said, even in that case, consider combining it with savings accounts and insurance, not just investments.

2. When investing in an account in your child's name

If you invest in an account under your child's name, there are two options available.

If you had opened a Junior NISA account by 2023, you can continue to operate it.

Investments made in a Junior NISA account, such as mutual funds and listed stocks, can continue to be operated tax-free until the account holder reaches adulthood by 2023. If there is no immediate need to use the funds, it is advisable to continue operating them tax-free as they are.

When your child becomes an adult (18 years old as of the date of the 1st day of the month), a new NISA account will be automatically opened. However, you cannot transfer the products managed in the Junior NISA account. You will have to choose to either transfer them to an adult taxable account (specific account) or use the funds from selling them to purchase new products in the (adult) NISA account.

If you need funds, you can sell the investment trusts and listed stocks held in your Junior NISA account and withdraw them tax-free. However, in that case, you must withdraw all products and close the account. You cannot sell only some financial products to withdraw or receive dividends from stocks each time.

It is important to note that Junior NISA is not subject to the 5-year tax exemption when leaving the country, which is different from the adult NISA. Therefore, if you become a non-resident due to studying abroad or a parent's transfer, the products held in the Junior NISA account will be transferred to a general account (taxable account) (*).

If you become a non-resident due to studying abroad or other reasons, consider the option of closing your Junior NISA account and withdrawing your funds.

(If you have opened a specific account, you can incorporate it into the specific account upon your return by going through certain procedures.)

②The portion to be invested from now on will utilize a minor account (taxable account) that will be opened.

You can open a minor account in your child's name at a financial institution and invest the various allowances, New Year's money, and gifts received. In this case, you will use a taxable account, and profits will be subject to taxation.

I am interviewing individual investors, and parents are brainstorming about what to purchase in their children's accounts. Some are efficiently accumulating index funds, while others hold investment trusts that emphasize dialogue with beneficiaries (mutual fund holders). In the latter case, it seems that by holding some investment trusts and participating in seminars and events that their children can attend, they aim to connect their children's awareness and experiences.

For example, Mr. A is investing in an index fund that invests in developed country stocks, emerging market stocks, and Japanese stocks in a ratio of 6:3:1 in his child’s account (minor account). There are index funds that invest in global stocks in one fund, but Mr. A explains that he chose the three index funds because "I thought it would be good to convey to the children that the price movements are different for each asset class when they are able to understand."

Mr. B is accumulating a global equity index fund in his child's minor account (80% of the total), while also combining it with an active fund that invests in some Japanese and American stocks. The reason is that he wants them to be aware that "investment trusts target individual company stocks, and their money is being invested in such companies (through the investment trust), allowing money and society to circulate." Therefore, he includes a little bit of active funds as well.

A minor account also implies long-term growth, but looking at these cases, I feel that there is also the perspective of how you want your child to feel and what you want them to learn, and there isn't just one correct answer.